Market Analysis Q4 2022

CapitalQuarter - Spring 2023

Market analysis Q4 2022

After the triumphant recovery of UK capital markets in 2021, as pent up demand for admissions fuelled resurgent capital markets, the macroeconomic and geopolitical landscape changed significantly in 2022. Investor sentiment was dampened by a plethora of factors from spiralling inflation rates and subsequent interest rate hikes, the war in Ukraine and a further deterioration of global supply chain issues heighted recessionary risk. This was all set against the backdrop of political turmoil in the UK and the revolving door of Prime Ministers in Autumn 2022. All have culminated in a quarter to forget for UK capital markets in winter 2022.

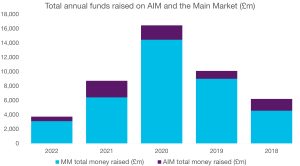

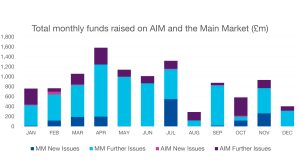

The final quarter of the year to December 2022 saw the lowest amount raised of any quarter in the year, with a combined total of £1.9bn raised across the Main Market and AIM. This is significantly down on the same quarter in 2021 and 2020 which saw £12.3bn and £15.8bn raised respectively. This completes the trend of significantly reduced activity in the year as a whole.

Whilst the quarter remains exceptional for the wrong reasons, there was limited IPO activity. There was a total of 11 new raises in the quarter; 8 on the Main Market and 3 on AIM. PKF were pleased to have acted as Reporting Accounting on 2 of these transactions on the Main Market and 1 transaction on AIM. Dial Square Investments Plc and Hellenic Dynamics Plc debuted on the Main Market whilst Smarttech247 Group Plc listed on the AIM exchange.

Smarttech247 Group Plc is a provider of AI enhanced cybersecurity services, providing automated managed detection and response for a portfolio of international clients. Smarttech247 Group PLC was admitted to the AIM market in December, raising gross proceeds of £3.67 million.

Whilst 2023 marks a new calendar year, the UK IPO market looks set to be plagued by old woes. As inflation continues to dominate conversations in the lunchroom of every central bank, further tightening of the monetary belt will squeeze the real economy and the risk of recession remains stark. The occurrence, severity and duration of recession in 2023 are all unknown but several institutions have revised their predictions as less severe than previously thought. Capital markets are incredibly responsive and should the macroeconomic landscape improve, we should see the suppression of IPO activity ease quickly. The expectation (and hope) is for the ice to thaw on the IPO market as July temperatures usher in the second half of the year.

Although the wider economic outlook continues to look bleak, the sentiment and confidence in the middle market is growing. The PKF team attended the Mining Indaba in Cape Town in February to catch up with our clients and contacts in the natural resources space. Although 2022 was tough, the belief in the ability to raise funds for key projects this year was present. A renewed vigour to fund projects, particularly in the battery metals space, highlighted the belief that regardless of the wider economy, transactions can still be completed. We at PKF look forward to supporting all our new and current client as they take on transformation transactions on the Capital Markets in 2023.