-

Administrators appointed over Finablr PLC

Stephen Goderski and Peter Hart of PKF GM were appointed as Joint Administrators of Finablr Plc on 11 March 2022.

-

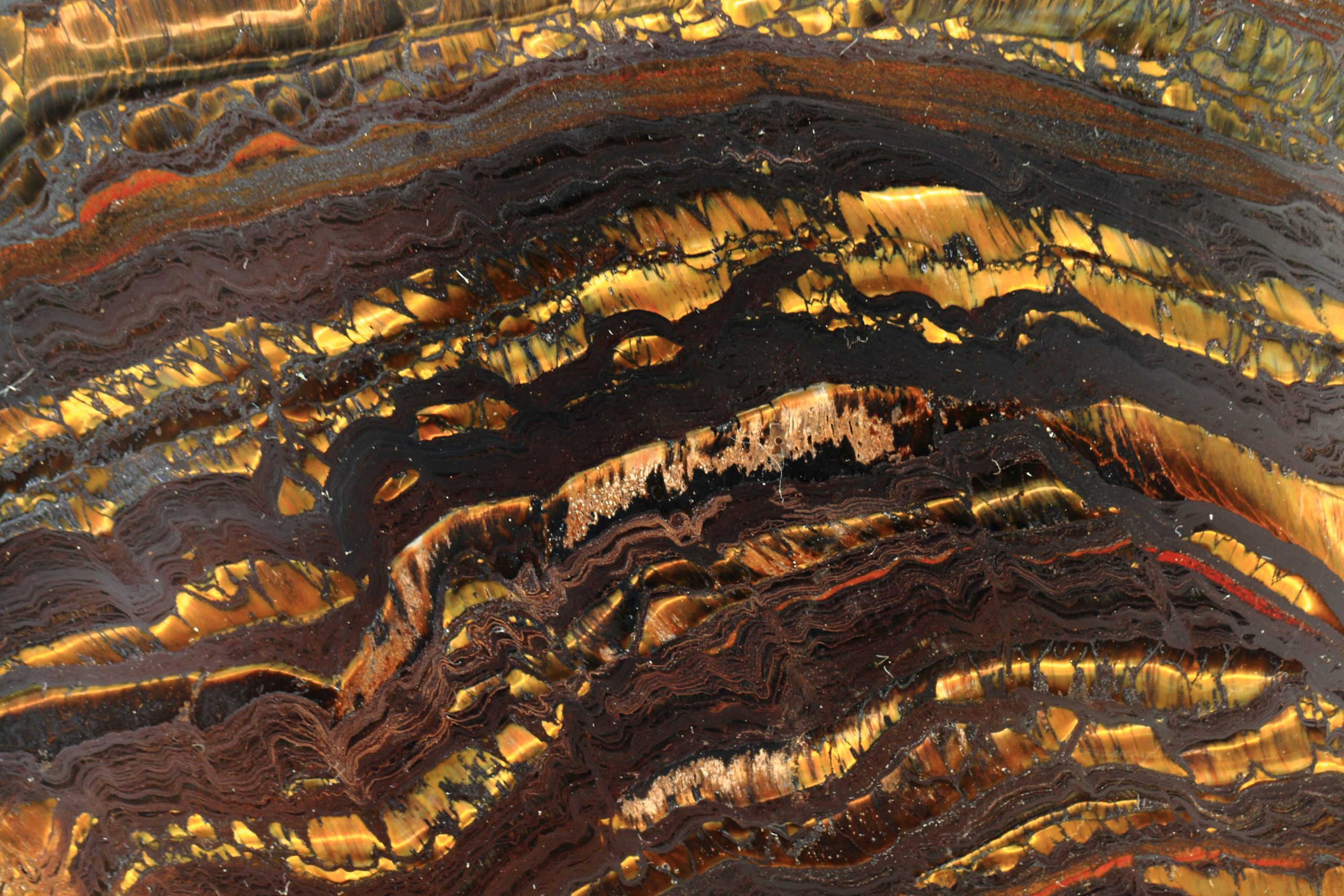

Deal alert: Hamak Gold Limited

We are delighted to have supported Hamak Gold Limited on their admission to the Main Market of the London Stock Exchange.

-

Digital Transformation in Action

In PKF Digital’s latest webinar, we look at idea generation, project governance and some example projects deployed with the Office365 platform.

-

Broking Business – Spring 2022

Welcome to our latest issue of Broking Business, our regular publication with current news and views for insurance intermediaries.

-

The challenge to corporation tax payments

With delays to some tax refunds and the impact of group companies on ‘profit thresholds’ both affecting cash flow, it’s worth another look at the corporation tax payment on account process.

-

Putting the consumer at the heart of operations

An update on the FCA’s Consumer Duty consultations and anticipated new rules.

-

Appointed Representatives: what the FCA is looking for

The FCA has published its consultation paper on improving the Appointed Representatives (ARs) regime. What should you expect?

-

Why intermediaries need to work on ESG

Regardless of their ownership or prevailing jurisdictional requirements, ESG and associated reporting should be a key focus of intermediaries.

-

Operational resilience: The final countdown

The 31 March 2022 deadline for implementing operational resilience frameworks is drawing closer. We share our observations on activity so far, and offer our tips on what firms should focus on in the coming weeks.

-

CASS 5: What are the burning issues?

Although firms’ compliance with the CASS 5 client money rules is improving, the FCA has started to look at specific areas of the CASS rules in more detail. So what should you look out for?

-

PKF climbs to third in AIM-listed auditor rankings

PKF’s Capital Markets team is now the third ranked auditor of AIM companies based on the number of clients.

-

PKF appoints new VAT Partner

PKF has appointed Mark Ellis as a VAT Partner in its London office. Mark has over 30 years of experience as a tax adviser.