The International Tax Enforcement (Disclosable Arrangements) Regulations 2020 (commonly known as DAC6), require the disclosure of cross-border arrangements, to HM Revenue & Customs (HMRC), provided certain criteria are met. These are structured in a similar way to our existing Disclosure of Tax Avoidance Scheme rules.

The first report to be filed on 30 January 2021, under the Regulations covers disclosable arrangements arising between 1 July 2020 and 31 December 2020. While the second report, due on 28 February 2021, covers all arrangements and transactions between 25 June 2018 to 31 June 2020.

What transactions must be disclosed?

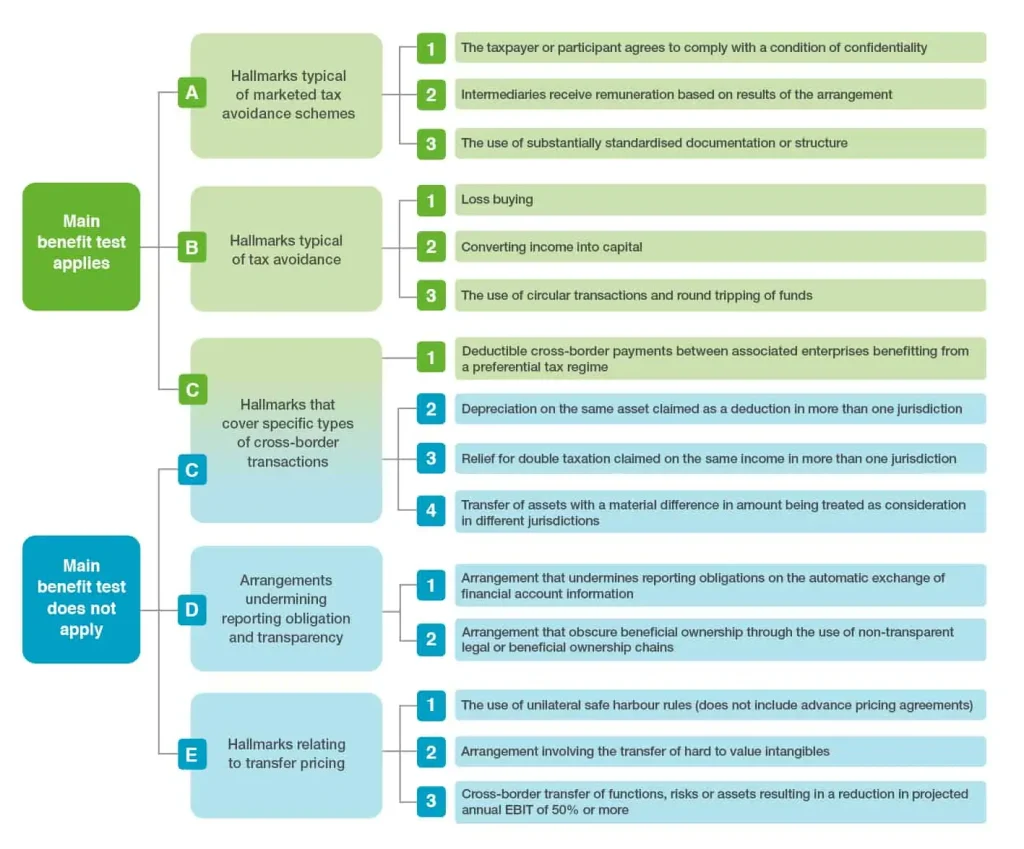

Any cross-border arrangement between an EU member state or the UK, and another country that meets one of the Hallmarks below will need to be disclosed. Some Hallmarks require the arrangement to meet the Main Benefit Test, where the main benefit or one of the main benefits of the arrangement is the obtaining of a tax advantage. Other Hallmarks simply require the disclosure of the arrangement, irrespective of the tax benefit or any previous disclosure to tax authorities.

The Hallmarks

Intermediaries with an EU nexus have the primary obligation to report. There is an exemption where legal privilege is claimed or where an intermediary, who has not been involved in the implementation of a reportable arrangement, subsequently becomes aware of the arrangement. If there are no intermediaries which can report, the obligation falls to the taxpayer.

An intermediary means any person that designs, markets, organises or makes available for implementation or manages the implementation of a reportable cross-border arrangement. It covers both “promoters” and “service providers” and can include associated group companies.

Reporting was initially due to commence on 1 July 2020. However, because of the impact of COVID-19, the UK together with most EU countries decided to delay reporting by six months. However, Germany, Austria and Finland did not defer reporting. The UK reporting deadlines are as follows:

- Look back period. Arrangements where the first step was implemented between 25 June 2018 and 30 June 2020 must now be reported by 28 February 2021

- Deferred period. Arrangements made available or ready for implementation, or where the first step in the implementation takes place between 1 July 2020 and 31 December 2020, must be reported by 30 January 2021

- Going forward. Arrangements which become reportable on or after 1 January 2021 must be reported within 30 days.

HMRC requires the information to be reported online and will update their guidance when the service is available (closer to the time). Taxpayers and intermediaries will only need to register once to use the service. The information to be disclosed includes:

- Your details, and the details of other people involved in the arrangement, including: name, date of birth, place of birth, residence for tax purposes, Unique Taxpayer Reference, National Insurance number or other tax identification number

- The people that are associated businesses to the relevant taxpayer

- The hallmarks which the arrangement applies to

- An explanation of the arrangement

- The legislation the arrangement relies on

- The arrangement start date

- The arrangement value

- Any EU member states or the UK, likely to be affected by the arrangement.

HMRC may impose penalties on either the intermediary or the taxpayer for various non-compliance infringements. For example, the following penalties could be imposed.

For failing to make a return, a penalty of up to £5,000 may be imposed. However, if HMRC consider that to be inappropriately low after taking in to account all relevant considerations, £600 may be imposed on top for each day during the initial period and if the failure continues after a penalty is imposed, a further £600 penalty per day on which the failure continues may be imposed.

If HMRC take a case to the First-tier Tribunal, the maximum penalty is £1 million.

Taxpayers should consider all transactions, structures and arrangements they have entered into since 25 June 2018 and determine if they fall within one of the Hallmarks. PKF can assist you with this evaluation process.

Where you are relying on an intermediary to disclose the arrangement, ensure that you obtain proof that disclosure was made at the appropriate time. If you are reporting yourself, ensure you have all the necessary information before accessing HMRC’s online system.

With the sharing of information between tax authorities, it is important to ensure that you are Transfer Pricing compliant and we can help you with this process as well as obtaining agreement with HMRC.

Finally, taxpayers should ensure that senior management is aware of the reporting requirements, that systems are implemented to monitor arrangements as they arise, that staff are adequately trained, and reports submitted when required.