The Financial Reporting Council (FRC) has overhauled lease accounting under FRS 102, aligning it more closely with IFRS 16. This change marks a significant shift for UK entities, especially small and medium-sized businesses, as it eliminates the traditional distinction between operating and finance leases for lessees. Whilst the requirements for lessors have also been rewritten, these will not differ significantly from current practice.

The new model for lease accounting brings greater transparency and comparability to financial statements prepared under IFRS, but also introduces new complexities in recognition, measurement and disclosure. These changes are effective for accounting periods beginning on or after 1 January 2026 but early adoption is permitted along with other amendments to FRS 102 including profit commission and transitional options, which are covered in other articles on our FRS102 hub.

Small entities reporting under Section 1A are also impacted but not those that report under FRS 105 ‘The Financial Reporting Standard applicable to the Micro-entities Regime’.

What is changing?

On-balance sheet recognition

Under the revised FRS 102, all leases (except for short-term and low-value leases) must be recognised on the balance sheet. This replaces the previous distinction between finance leases (on-balance sheet) and operating leases (off-balance sheet). This results in more leases requiring recognition of a right-of-use (ROU) asset and a corresponding lease liability.

|

Balance sheet |

Profit and loss account |

Cash flow statement |

|---|---|---|---|

Current FRS 102 Section 22 |

No asset or liability is recognised. |

Lease / Rental expense (Operating expenses) |

Operating activities |

Current FRS 102 Section 22 |

Finance lease liability+ |

Finance charges+ |

Interest paid (financing or operating) |

FRS 102 amendments |

Lease liability+ |

Interest expense+ |

Principal portion of lease liability (financing) + Interest paid (financing or operating) |

Measurement of lease liability

To calculate the lease liability, it is necessary to determine:

- The unpaid lease payments as of the calculation date, and

- An appropriate discount rate to present value the future lease payments.

The discount rate used by the lessee should be the interest rate implicit in the lease, if it can be readily determined. If not, the lessee must choose, on a lease-by-lease basis, to apply either:

- The Incremental Borrowing Rate (IBR), or

- The Obtainable Borrowing Rate (OBR).

Incremental Borrowing Rate:

The rate of interest a lessee would have to pay to borrow, over a similar term and with similar security, the funds necessary to obtain an asset of similar value to the right-of-use asset in a comparable economic environment.

Obtainable Borrowing Rate:

The rate of interest a lessee would have to pay to borrow, over a similar term, an amount equivalent to the total undiscounted lease payments included in the lease liability.

Note: In practice, the rate implicit in the lease is not evident from the lessee’s perspective. FRS 102 does not prescribe a specific methodology for estimating either the IBR or OBR. Under IFRS most preparers currently use the IBR and the OBR is not available as an option. The FRC has included the OBR as a simplification in the FRS 102 amendments but those who report to IFRS groups should be aware that using the OBR might result in a GAAP difference.

Measurement of the right-of-use (ROU) asset

The ROU asset is initially measured at cost, which comprises:

- The initial amount of the lease liability, plus

- Any lease payments made at or before the commencement date, plus

- Any initial direct costs incurred, plus

- An estimate of costs to dismantle, remove, or restore the underlying asset or the site on which it is located.

Exemptions

The amendments include voluntary recognition exemptions for short-term leases and leases for which the underlying asset is of low value. These exemptions permit lessees to leave eligible leases off the balance sheet and recognise them in a similar manner to operating leases (ie expense on a straight-line or another systematic basis).

A short-term lease is one that, at the commencement date, has a lease term of 12 months or less and does not include a purchase option.

Determining the lease term may require judgment, as the lessee must consider any extension or termination options. These options should be evaluated based on whether there is reasonable certainty that they will be exercised or not. This assessment is essential to accurately determine the lease term and whether the lease qualifies as short-term.

The value of an underlying asset is assessed in absolute terms, without reference to an entity’s materiality or the value of the lease payments. While the amendments do not prescribe a specific value threshold, they do provide examples of asset types that are not considered low value, such as motor vehicles, aircraft, land and buildings. This list is not exhaustive, and preparers should assess whether a leased asset is of comparable value to those listed. Examples of assets that may qualify as low value include tablets and personal computers, small office furniture and telephones.

Accounting challenges and judgements

The amendments present several practical accounting challenges and judgements, including:

- Identifying a lease: Determining whether a contract contains a lease requires careful analysis of whether there is an identified asset and if the lessee controls its use. This can be especially tricky in service or outsourcing arrangements.

- Determining the lease term: Entities must assess the non-cancellable period plus any optional extensions or terminations that are ‘reasonably certain’ to be exercised, requiring significant judgement.

- Separating lease and non-lease components: Contracts often bundle services with asset use, and lessees must allocate consideration unless they elect the practical expedient to treat all as a single lease.

- Estimating the discount rate: As highlighted above where the interest rate implicit in the lease is not available, entities must estimate their incremental borrowing rate. This is often a challenge for smaller businesses, however the OBR does offer a simplification.

These areas demand robust judgement, documentation, and often system upgrades to ensure compliance and consistency.

Simplifications from IFRS 16

As noted above, there are several simplifications under FRS 102 compared to IFRS 16, particularly in the areas of discount rates and low-value assets.

In addition:

- Sale and leaseback transactions: Entities have greater flexibility in accounting policy choices due to less prescriptive guidance. This typically results in simplified gain or loss recognition, with no requirement to allocate gains based on retained rights.

- Lease modifications: For certain types of lease modifications, there is no requirement to revise the discount rate when remeasuring the lease liability, reducing complexity in ongoing lease accounting.

Transitional provisions

Lessees are required to apply the amendments retrospectively, but comparative information is not restated. Instead, the cumulative effect of applying the new lease accounting standard is recognised as an adjustment to the opening balance of retained earnings (or another appropriate component of equity) at the date of initial application.

The tax rules were amended in 2019 to accommodate right-of-use assets and lease liabilities under IFRS 16. The HMRC manual is being updated for the amendments and as a result we do not expect further changes to tax statute. Therefore, for UK entities, where these transition adjustments relate to leases, the UK tax treatment detailed in the Finance Act 2019 provides further relief:

- These adjustments are not taxed immediately.

- Instead, they are spread over the remaining average life of the leases, allowing for a gradual tax impact.

Because the timing of taxation differs from the period in which the adjustments are recognised for accounting purposes, it is important to assess whether a timing difference arises, which may require the recognition of deferred tax.

Entities that are part of an IFRS group may apply a practical expedient at the date of initial application. Under this expedient, a lessee may recognise the carrying amounts of lease liabilities and right-of-use assets as determined under IFRS 16, solely for the purpose of inclusion in consolidated financial statements prepared in accordance with IFRS Accounting Standards.

- If this practical expedient is elected, the entity must apply it consistently to all leases and disclose the use of the expedient in its financial statements.

On transition, entities are not required to reassess whether existing contracts contain a lease. Instead, they may apply the requirements of the amendments only to:

- Contracts that were previously identified as leases

- Contracts that are entered into or modified on or after the date of initial application.

For contracts that were not previously identified as leases under the former FRS 102 requirements, entities are permitted to grandfather those assessments. In other words, the revised lease accounting requirements do not need to be applied retrospectively to such contracts.

Disclosure Relief on Transition: On initial application of the revised Section 20, an entity is not required to disclose the information specified in paragraphs 10.13(b) to (d) of FRS 102. Most notably, this means there is no requirement to disclose the transition adjustment for each affected line item in the financial statements.

Instead, the entity must disclose, for the current period and to the extent practicable, the overall adjustment to profit or loss resulting from the application of the revised Section 20.

If providing this information is impracticable, the entity should explain why.

Key financial impacts

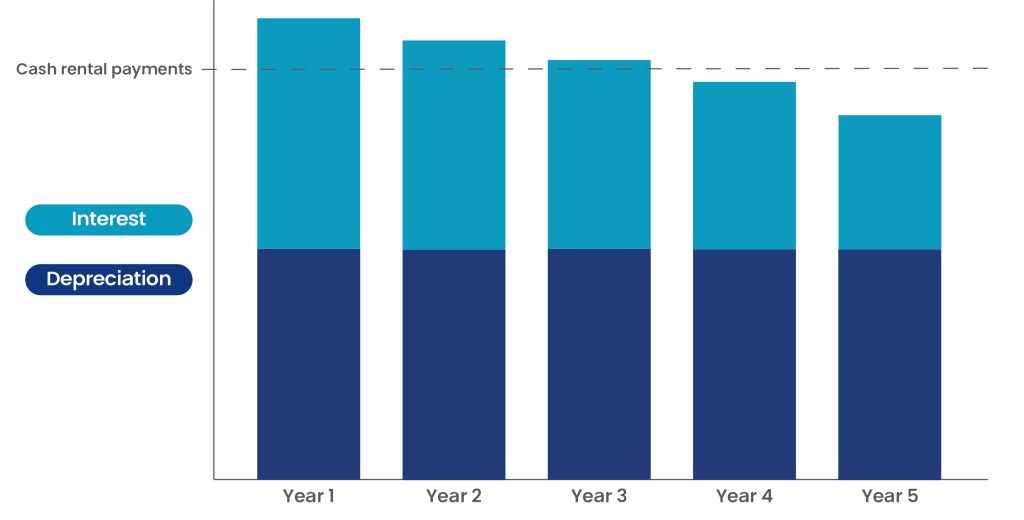

The result of the changes will result in the lease expense being front loaded in the P&L. As a result key metrics will be impacted, which could impact debt covenants.

This might lead to an increase in non-GAAP measures such as EBITDA, as previously the expense relating to an operating lease would have been included in operating costs. Conversely, earnings per share (EPS) should decrease at the start of the lease term but will increase towards the end, because of the front loading of the expenses in P&L.

By bringing on both a lease liability and a right-of-use asset there will be an overall increase in the total assets. There will be a mismatch between the asset and the liability over the lease term that will lead to a decrease in net assets over the lease term. The current ratio might be adversely impacted on transition due to the gross up of the balance sheet.

Conclusion

The upcoming changes to lease accounting under FRS 102 represent a significant shift for FRS 102 and FRS 102 Section 1A reporters, particularly those that have historically relied on the operating lease model. While the revised standard enhances transparency and comparability, it also introduces new complexities in recognition, measurement and disclosure. Entities will need to carefully assess their lease portfolios, make informed judgments around discount rates and lease terms, and prepare for the financial and operational impacts – especially on key metrics such as EBITDA, EPS and gearing.

With the effective date fast approaching, early planning and a structured implementation approach will be critical to ensure a smooth transition and compliance with the new requirements.

How PKF can help

We understand that navigating accounting change can be challenging – especially when it affects systems, processes and financial reporting. Our team of financial reporting specialists can support you with:

- Impact assessments tailored to your lease portfolio

- Technical accounting advice on applying the revised FRS 102 requirements

- Discount rate and lease term evaluations, including support with IBR and OBR methodologies

- Transition planning and implementation support, including practical expedients and disclosure requirements

- Training and workshops for finance teams and stakeholders

- Tax and deferred tax analysis related to lease transition adjustments

- Assistance with system readiness and data capture for lease accounting.

Whether you are a standalone entity or part of a wider IFRS group, our Financial Accounting Advisory team can help you interpret the changes, manage the transition and ensure your financial reporting remains robust and compliant.

For more information or to schedule a consultation, please contact our FAAS team.