William Godsave of Credo, our wealth management partners, looks at the volatility across the global markets following President Trump’s de-regulation and tax cutting agenda.

2025 market volatility

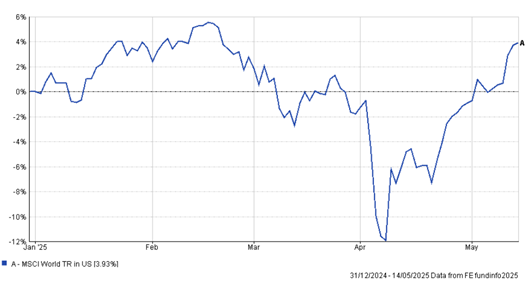

The start of 2025 brought a wave of volatility across global markets. Initially buoyed by President Trump’s de-regulation and tax cutting agenda, the market experienced a sharp sell-off in April following the announcement that reciprocal tariffs would be placed on all countries with trade barriers against the US. This downturn was compounded by the introduction of Trump’s “Liberation Day” policies. The result, seen in the MSCI World (USD) index below, was a peak-to-trough movement of just over 16% between mid-February and the start of April. This was followed by a swift recovery, and by mid-May the global markets were back to where they were at the start of 2025.

Historical context

While this sharp downturn and speedy recovery may feel like a significant movement for many investors, it is far from uncommon.

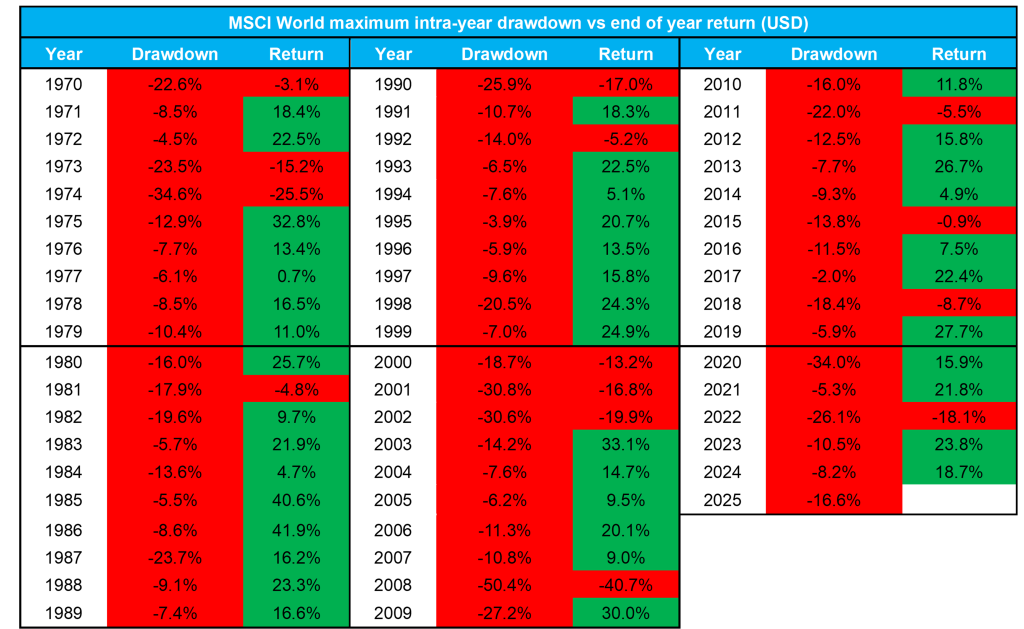

The table above puts these types of drawdowns into historical context by showing the maximum intra-year drawdown (middle columns) in each year since 1970 and the year-end return of the MSCI World (USD) index (third columns).

The maximum drawdowns within any given year are often in double digits, and declines of over 20% are experienced regularly. Despite this, the overall returns for the year are typically still positive or at least notably less negative than the maximum drawdown. Uncertainty in the world (economic, political, or otherwise), and the volatility in the equity markets which goes along with this, are a feature of the market in almost every year throughout history.

Implications for your portfolio

We accept that volatility is a feature of the equity market and is the “price to pay” for the potential for long-term returns. Moreover, timing the market and reducing volatility by trying to anticipate the peaks and troughs in advance is very difficult to achieve consistently in practice.

We believe that the most important decision is therefore to decide your overall asset allocation and the proportion that should be invested into equities compared with other diversifying asset classes (e.g. fixed income and alternatives). This decision is primarily based on your risk tolerance, objectives, liquidity requirements, and the rate of return required to meet your goals.

A well-constructed allocation at the outset which is built for the long-term will allow you to invest and ride through the volatility without panicking and will enable you to stay on course through the ups and downs which are inevitable in the market.

Important Notice

This marketing material has been prepared and issued in the United Kingdom by Credo Capital Limited (“Credo”). It is provided to you for discussion purposes only and does not constitute and should not be interpreted as either investment advice (including legal, tax or accounting advice) or a trading recommendation. This marketing material is not a solicitation to buy or sell any financial instruments or commodities, a recommendation to participate in a particular trading strategy or to invest into regulated or unregulated funds. The value of an investment can fall as well as rise and is not guaranteed, your capital may be at risk and you may not receive back your original investment in full.

Credo Capital Limited is a company registered in England and Wales, Company No: 03681529, whose registered office is 8-12 York Gate, 100 Marylebone Road, London, NW1 5DX. Authorised and regulated by the Financial Conduct Authority (FRN:192204). © 2024. Credo Capital Limited. All rights reserved.