What have been some of the most significant themes in the UK broker market over the past 12 months? John Needham and Will Lanyon explore the impact of some of the main macroeconomic developments on industry trends such as M&A activity and market concentration.

The following article has been taken from our work with Insurance Age in their Insurance Age Top 75 feature. The original article can be seen here.

Inflationary pressures being managed

The insurance industry proved adept at dealing with the macroeconomic shock posed by the Covid pandemic back in 2020 – and it appears to have proved equally resilient to the more recent phenomenon of a higher and less certain inflationary environment.

Higher staff costs have been a major area of concern for brokers, like in many professional services sectors, which has lowered the margins of some. However, as a rule, the sector has been able to manage these cost increases by continuing to grow its top line. Premiums have been rising steadily over the past few years due to the hard market conditions, and the surge in inflation during 2022 and early 2023 has added further upward pressure across multiple products and classes.

Outside of personal lines, the rise in premiums does not appear to have resulted in clients shopping around – renewal rates remain robust, particularly at the larger and more complex end of the market. Some firms have exhibited good organic growth through a combination of rate rises, good retention rates and some moderate new business wins.

Interestingly, the rise in interest rates precipitated by higher inflation has provided a boost for brokers with large premium money holdings. These cash balances previously earnt very little interest income, but that is now starting to change. However, for brokers requiring debt funding, the benefit of higher interest income tends to be outweighed by the more expensive cost of borrowing, as we explore below.

Higher interest rates starting to temper deal making

As regular readers of Insurance Age will be aware, merger and acquisition activity in the sector remains at an elevated level.

However, higher interest rates have had an impact on dealmaking at the top end of the market.

The higher cost of borrowing has meant that larger deals are less common than before and are taking longer to complete, with some even being shelved part way through the process. We are also seeing a slow-down in consolidation in the domestic market, although larger groups remain active by focusing their attention on overseas acquisitions.

The price paid by acquirers – as measured by a multiple of the target company’s future earnings – is now stabilising after years of growth. These earnings forecasts are being scrutinised more closely than before, with buyers tending to be more conservative about their growth assumptions – they’re no longer giving targets the benefit of the doubt in the same way that they did previously. That said, we understand a few larger deals are now starting to emerge, so we will see over the coming months how they progress.

Small deals still going through at a good rate, with the traditional consolidators remaining the most active from an M&A perspective. The most prolific consolidators have still completed a large number of deals in the past year, at a level that is broadly comparable to last year. The valuation multiples for these smaller deals are also holding up well.

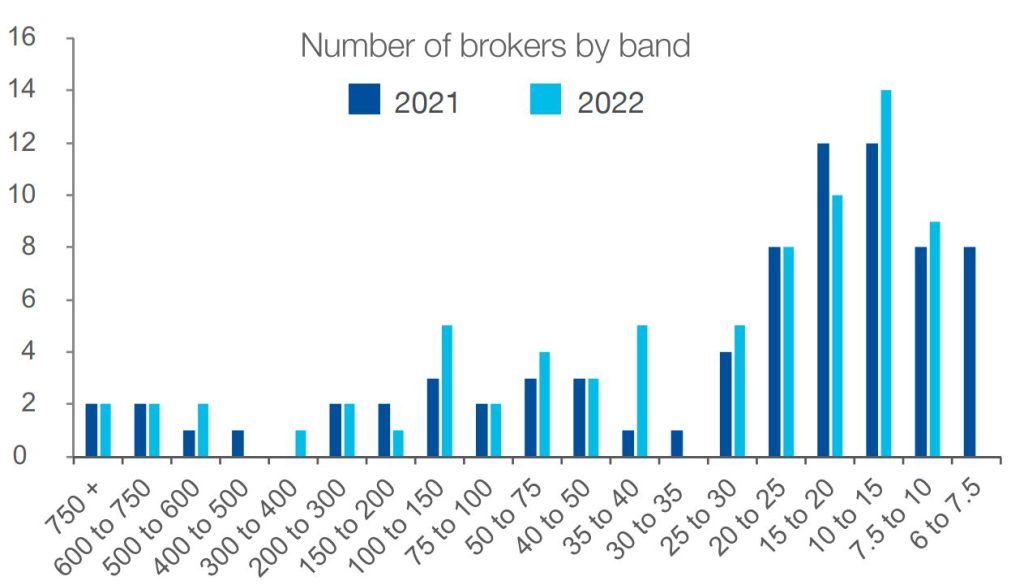

The result is that the largest players in the broker market are larger than ever before. The majority of broking revenue is concentrated with the big international brokers, with the largest six operators accounting for over 60% of the industry’s total revenue in each of the past two years. The past 12 months also saw some of the large US brokers making significant further entries into the UK.

It is worth noting that higher interest rates not only affect those brokers that are currently undertaking debt-financed acquisitions – firms that borrowed to pay for acquisitions in recent years are also likely to be impacted, especially if they are now having to refinance. This will be something to watch over the coming year.

Private ownership model in decline

As well as examining some of the current industry developments, we also wanted to revisit one of the themes that we identified in last year’s report – namely the decline of the private ownership model.

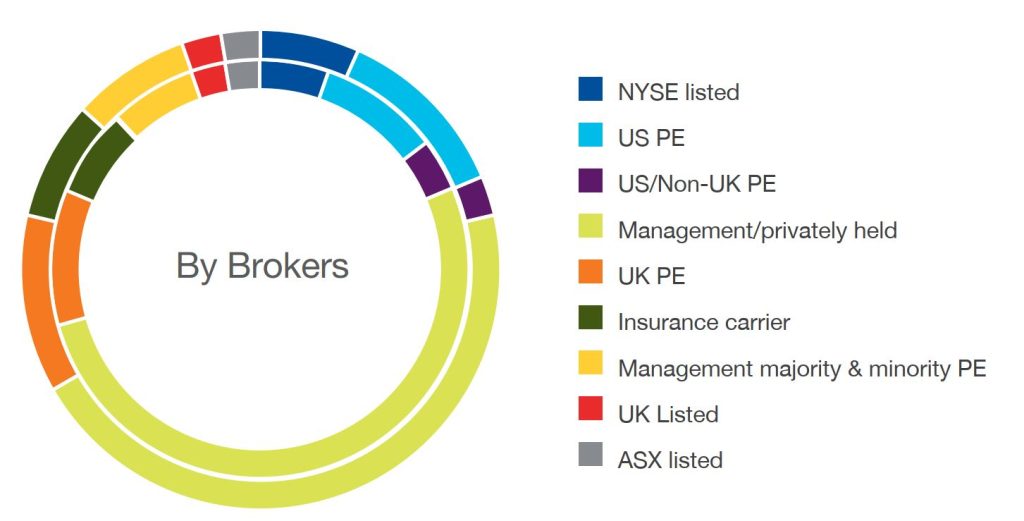

We noted last time that just over half of the brokers in our universe were privately owned, making this the most common ownership model – at least for the time being.

However, as predicted, the percentage of privately owned brokers has continued to reduce year-on-year – driven by the fact that these brokers generally tend to be smaller, and are a popular acquisition target for the consolidators. We expect their number to continue to decline in the future.

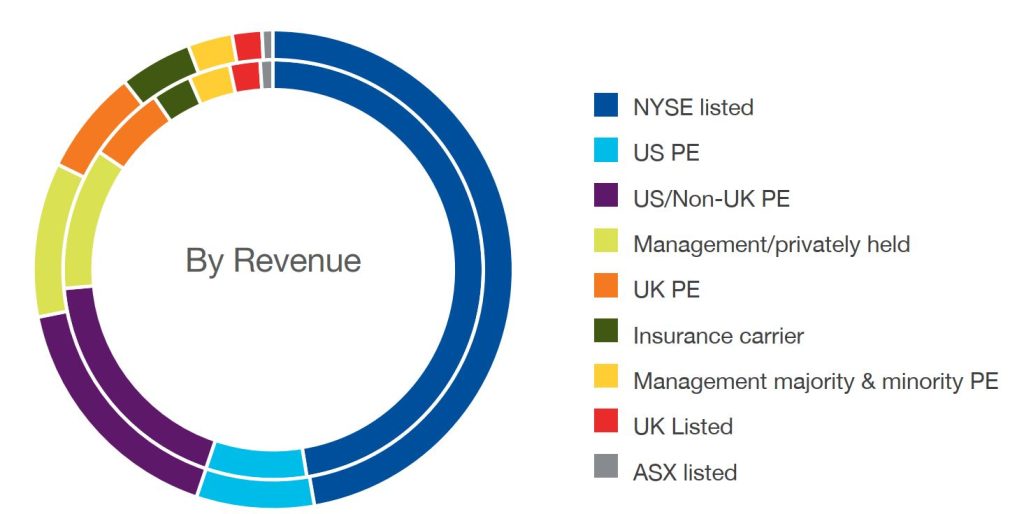

The picture changes significantly when looking at the ownership of brokers by their share of revenue. The large US listed brokers are the most dominant – representing 47% of the total – and this has increased slightly in the past year as Brown & Brown has continued its acquisition-led growth strategy.

As would be expected, the private equity industry is a major player in the UK broker market, owning roughly a third of the brokers by number and by revenue. There has been a significant flurry of PE-backed acquisition activity in recent years; after a slight dip in 2022, activity appears to have rebounded this year, with two new private equity deals recently being announced, Blixt’s acquisition of Academy and Apiary’s acquisition of Carbon.

How we have analysed the data provided

- We have been provided data from Insurance Age and Insuramore for UK non-life broking for the top brokers in the UK based on 2021 and 2022 financial results. Information for 2021 and 2022 was for more than 75 brokers but we have capped at the top 75 for both years

- PKF has consolidated brokers where we know of transaction in the last twelve months. If the acquisition occurred in 2022 or 2023 we grouped the balances together in the 2022 numbers but not 2021. Where the acquisition occurred in 2021 or earlier they are included within the new Group’s numbers

- The information was less granular than in the prior year and, as such, we have had to make the assumption that the average value of the bandings was the midpoint between the bandings. When grouping entities that have been acquired, we used our market knowledge and estimates of the bandings to ascertain the banding and therefore the midpoint.