Accounting for your long-term contracts under IFRS 15 – Revenue from Contracts with Customers (“IFRS 15”) can be complex. Why you should keep an eye on loss making long-term contracts under IFRS 15 and what your auditors need you to prepare.

Revenue recognition of large scale projects

Long-term contracts relate to large scale projects spanning multiple reporting periods and are found in many industries, including those outside of construction, such as software and technology, advertising and marketing.

Long-term contracts could have either one or multiple performance obligations. When applying the five principals of IFRS 15, the company must divide the contract into separate performance obligations, assigning their respective transaction price to each based upon its observed or estimated standalone selling price at contract inception. The company is required to determine when the customer has control of the contracted good or service. This should be disaggregated into categories to demonstrate how the nature, amount, timing and uncertainty of revenue and cash flows are affected by economic factors.

Contract balances

It is important that your application of accounting is appropriate to the revenues and expenses that are identified and recorded over a prolonged period.

Costs should be recognised as an asset under IFRS 15 where the following criteria are met:

- The costs relate directly to the contract

- They are used to meet performance obligations

- They are expected to be recovered.

Each of these above points must be met in order for the cost to be capitalised.

An assessment for whether a cost should be included in your contract asset can be considered as follows:

Costs that relate directly to a contract |

Costs that should be expensed when incurred |

|---|---|

Direct labour – For example, salaries and wages of employees who provide the promised services directly to the customer. |

Indirect labour – Ie, staff costs for finance and admin team that operate in business day to day operations and not specifically for this contract. |

Direct materials – For example, supplies used in providing the promised services to a customer. |

General and administrative costs (unless and costs are clearly and explicitly chargeable to the end customer). |

Allocations of costs that relate directly to the contract or to contract activities – For example, costs of contract management and supervision, insurance and depreciation of tools, equipment and right-of-use assets used in fulfilling the contract. |

Sunk costs – Ie, costs that are required to fulfil the contract but were not reflected in the price of the contract and the cost will not be able to be charged on to the customer. |

Costs that are explicitly chargeable to the customer under the contract. |

Costs related to previously satisfied performance obligations, if the obligation has been met, therefore revenue is recognised, any costs incurred subsequent to this should be expensed. |

Other costs that are incurred only because a company entered into the contract – For example, payments to subcontractors. |

FRC common deficiencies

The FRC highlighted a number of common deficiencies in the recognition and disclosure of contract balances in their 2022-23 Annual Review of Corporate Reporting. Entities should be aware of the following in future reporting by ensuring:

- there is sufficient information related to accounting policies for capitalised contract costs and disclosures related to judgements and estimates

- The correct classification of allowable costs is applied to contract balances, rather than inventory

- There is sufficient explanations of significant changes in contract balances.

In summary, entities need to adequately disclose how they have assessed the accounting treatment of contract balances, the specific judgements and estimates which have gone into this assessment and the reasons why management believe these to be appropriate, and details of material movements year on year.

Loss-making contracts (onerous contracts)

Any contract, be it short or long term, should be monitored closely to determine if it is profit making. All contracts should be observed continuously over the life of the contract to ensure no slippage is made and the contract does not become loss-making.

It is often the case that long term contracts can take longer than expected to complete. Assessing if the contract is still profit-making can be complicated by the significant uncertainty and timing of fulfilling performance obligations. Close project management is key, not only to ensuring milestones and deliverables are met, but also to keeping track of the profit margin and identifying if the requirement to recognise an onerous provision is triggered. This is when there is an expected loss at the date the performance obligation is expected to be met.

Provided that good records are kept, assessing costs to date should be straightforward. The judgement comes when trying to predict the costs to complete and the timing of when completion will be.

Having to look forward and predict the profitability of a contract in the early stages can be challenging. The longer the contract, the greater the level of uncertainty and potential margin for error. It is rare that a large projects will turn out as expected, and the cost of this uncertainty can impact the accounting involved in revenue recognition.

Management needs to monitor the position of the need to account for any potential loss, assess this at each period end, remeasure the degree of progress and re-recognise revenue as appropriate.

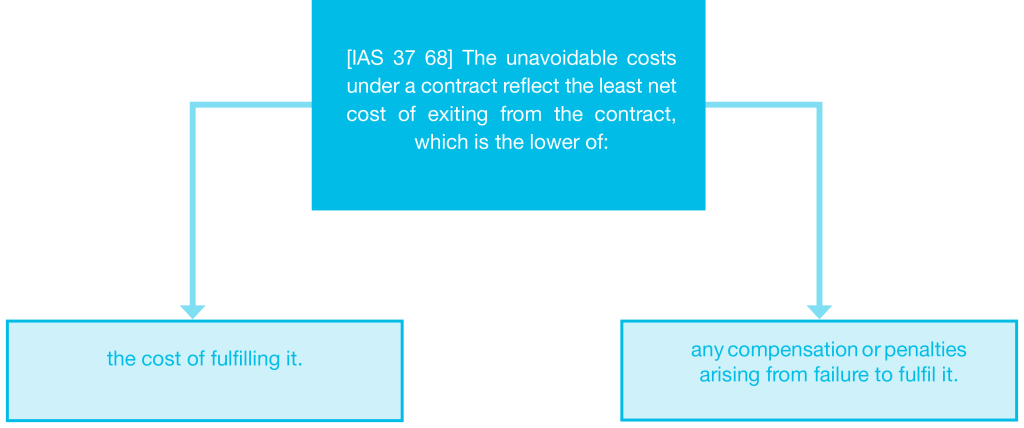

If a company has a contract that is onerous, the present obligation under the contract should be recognised and measured as a provision.

The cost of fulfilling a contract comprises the costs that relate directly to the contract. Costs that relate directly to a contract consist of both:

- the incremental costs of fulfilling that contract – for example, direct labour and materials; and

- an allocation of other costs that relate directly to fulfilling contracts – for example, an allocation of the depreciation charge for an item of property, plant and equipment used in fulfilling that contract among others.

Before a separate provision for an onerous contract is established, the company needs to recognises any impairment loss that has occurred on assets dedicated to that used in fulfilling the contract.

What do auditors need from their clients on loss making contracts?

Auditors are required to challenge management on their assessment of each contract – including the direct costs required to fulfil the contract, to be assessed at each year end (or more frequently), and therefore whether the contract is in a loss making position.

Management need to provide auditors with a breakdown of the costs to fulfil the contract and an analysis of the judgements used for future expected costs, and assess this in line with the requirements of IFRS as summarised earlier within this article. It is essential that management maintain good accounting records in respect of all accounting matters, with both historic actual evidence of performance as well as justification of future expected performance, and perform their own assessment of contracts in advance of the auditor’s visit.

For further information or guidance, please contact Joseph Archer.