In just over three months, on 1 January 2023, the new international accounting standard, IFRS 17 Insurance Contracts, will come into effect and change the financial reporting of insurance companies. We explain how this will impact our clients.

The goals of IFRS 17 are to ensure consistency across the accounting for all insurance contracts, increase comparability between insurance companies, and drive more detailed disclosures.

The reporting of larger insurers’ interim results at 30 June 2022 was expected to provide more detail on the impact of IFRS 17. But most insurers have decided to wait until later this year and into 2023 to disclose the full accounting consequences of adopting this new standard. This reflects the substantial amount of work that insurers still need to do.

IFRS 17 will bring substantially larger changes to the multi-line and life insurers that dominate the IFRS 17 headlines, with less of an impact for those writing short tail business. Along with the accounting policy practices already in force, the impact of the introduction of IFRS 17 may be more modest for the latter. It’s worth noting, though, that IFRS 17 will change the presentation of all insurer financial statements on transition and in the future.

Earnings recognition and measurement

A key element of IFRS 17 is the requirement to use a measurement model for insurance contracts, relating to how estimates are remeasured in each reporting period.

There are three options available:

- General Measurement Model (GMM) – suitable for long-term contracts

- Premium Allocation Approach (PAA) – suitable for short-term contracts

- Variable Fee Approach (VFA) – suitable for contracts with discretionary participation features.

Are we eligible for PAA?

In order to implement the simplified PAA over the more granular and time-consuming GMM option, the company must be satisfied that:

- the coverage period for each contract is no longer than one year, or

- the measurement of the contract isn’t expected to be materially different by applying PAA rather than GMM.

For the majority of our clients in the non-life insurance sector, the contracts they write satisfy either of the above two requirements. As expected, our clients are opting for the PAA approach for its simplicity and ease of use over the more technical and detailed GMM.

Overview of PAA

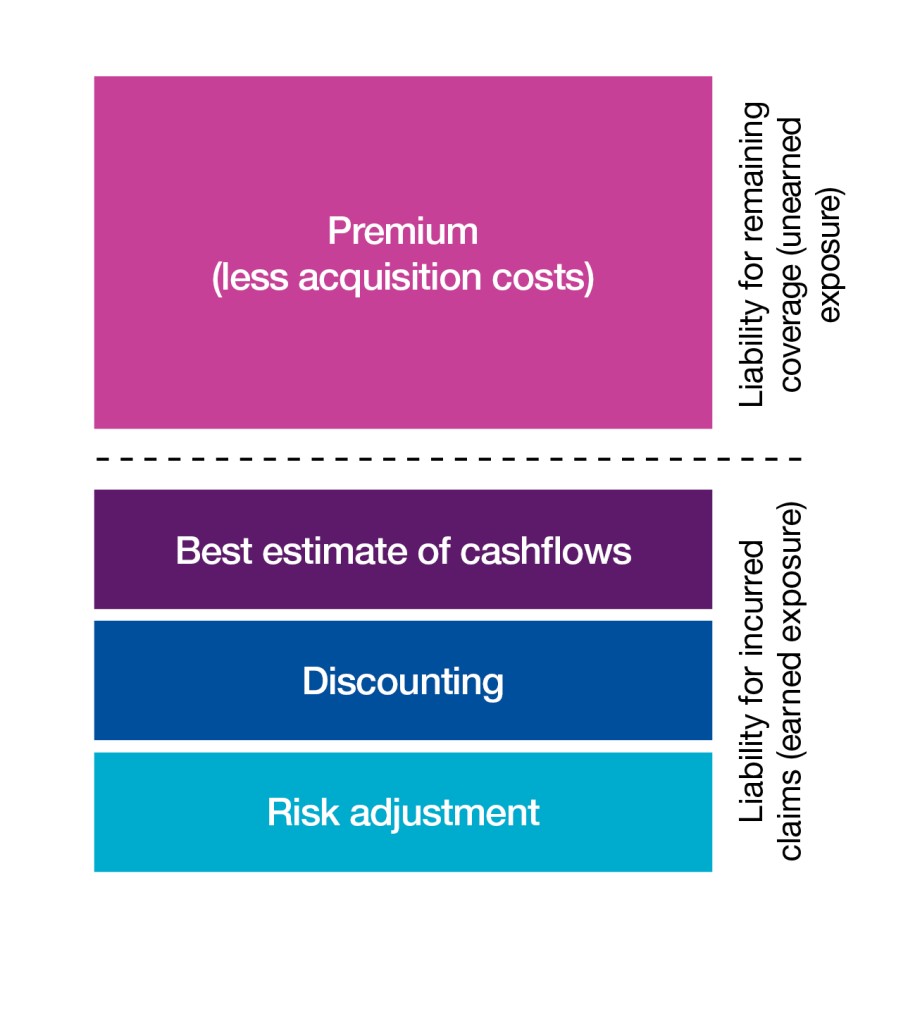

The chart to below shows the different components of the balance sheet under IFRS 17 when using the PAA approach.

Under the PAA approach the liability for remaining coverage (unearned exposure) is analogous to the UPR less DAC under IFRS 4.

For the liability for incurred claims (earned exposure) there are two key changes. These are the implementation of discounting of reserves and the use of a risk adjustment. The approach for determining these two elements is outlined below.

Discounting

The key considerations when working out suitable discount rates to use include:

- choosing between a ‘top-down’ and ‘bottom-up’ approach to calculate discount rates and

- identifying the inputs required, where these inputs will come from, and how discount rates will be updated over time.

Top-down vs bottom-up

A bottom-up approach involves selecting a risk-free yield curve and determining an appropriate illiquidity premium based on the nature of the liabilities.

A top-down approach uses a yield curve based on a notional target investment portfolio and deducts an allowance for credit risk and for asset-liability mismatching.

The majority of our clients implement a bottom-up approach. This is because, although there can be challenges in determining an appropriate illiquidity risk premium, this should be more straightforward than both estimating the credit risk premium and selecting the notional investment portfolio.

Determining discount rates

If implementing a bottom-up approach, which seems to be the industry standard, the first step is to determine the appropriate risk-free rates. Clients are tending to implement risk free rates consistent with those adopted in their Solvency II Technical Provisions models. For the vast majority this leads to using risk free rates published by EIOPA. These have key advantages including timely publication and extensiveness, such as long maturity periods and range of currencies.

Some clients are deciding not to allow for any illiquidity premium in their discount rates. But we believe the accounting standard expects insurers to implement this. Many firms are using the Volatility Adjustment published by EIOPA, which tends to be used in Technical Provisions models.

Alternatively, there is the option to estimate the liquidity premium from first principles using internal models. Either of these approaches would be reasonable. Note that all liabilities have different characteristics (for example, the Liability for Remaining Coverage is much more liquid than the Liability for Incurred Claims). But we think the best approach is to derive a single illiquidity premium based on the overall or average level of liquidity of the liabilities.

Risk adjustment

There is a requirement for reserves under IFRS 17 to be set on a pure best estimate basis. Insurers are then able to make a separate allowance, via a risk adjustment, for the uncertainties related to the amount and timing of cash flows. Under the PAA approach, the primary risk allowed for within the risk adjustment for the liability for incurred claims is reserve risk (uncertainty of the projected claims cash flows).

Calculation method

IFRS 17 does not specify how the risk adjustment should be calculated. Despite this, most clients adopt the same methodology. This is a confidence level approach, where a distribution of outcomes is derived and the confidence level selected so that there is a certain probability of the reserves being sufficient. For example, if they selected a 90% confidence level for the risk adjustment, the total reserves would be sufficient to cover the ultimate claims nine times out of ten.

The confidence level approach is more popular than the alternative cost of capital approach. This is because it’s relatively easy to calculate and explain and offers more timely availability of inputs. These are primarily driven by the independence of the calculation to an insurer’s capital model results.

Choice of distribution

The approach we are seeing most is for insurers to leverage work done to model reserve risk as part of the Solvency II SCR calculations, when determining suitable distributions. In particular, clients are using a log-normal distribution to model reserve risk with a coefficient of variation based on an ultimate time horizon, rather than the one-year time horizon used in the SCR calculation.

Confidence level

The selected confidence level is a decision for management and should reflect their risk appetite. But it’s important that the selection is broadly in line with that of other insurers in the market. Most insurers are expected to set the confidence level at somewhere between 70% and 90%.

How are our clients responding to IFRS 17?

We’ve talked about some of the choices insurers will need to make in adopting the new standard. Many of our clients are progressing well in finalising their accounting policies and measurement models.

But, for all insurers, operating under IFRS 17 will require additional data and a more challenging measurement model. This introduces further complexity and cost and requires substantial investment in finance and actuarial processes. And this has prompted some of our clients, with our help, to consider whether IFRS 17 is the best accounting basis for their business.

As a result we have seen clients elect to voluntarily change the basis of their accounting from IFRS to Generally Accepted Accounting Principles in the United Kingdom (UK GAAP), if they are domiciled in the UK. If they are domiciled in an overseas jurisdiction, some have opted for United States of America (US GAAP). The main reason for adopting these different GAAPs is the substantially increased complexity when accounting for legacy insurance transactions, both historically and in the future. Not to mention the ever more onerous disclosure requirements of IFRS 17.

What is clear is that for insurers adopting IFRS 17, early engagement with auditors is vital. This will allow potential issues to be identified and resolved early on, minimising the chances of last-minute surprises. It will also mean that feedback is received in good time, giving confidence over the key decisions that are critical to the project. Engaging auditors early will help insurers to be compliant with the requirements of IFRS 17 and many of our clients have already reached out to us for assurance over their dry runs. Ultimately, this reduces pressure on both finance and audit teams in the year of transition.

There are many moving parts to the implementation of IFRS 17 on 1 January 2023. Insurers are setting up and testing systems and refining critical accounting judgements. And, over the next few months, insurers will be releasing more information about the real-world consequences of IFRS 17. An interesting time not only for insurers, but also for shareholders and other stakeholders.

UK decides on tax implications of transition

Upon transition, life insurers will have a large one-off transitional profit or loss, which is undesirable both for them and for the tax authorities.

On 20 July 2022 the UK Government announced that it will allow the insurers’ adjustment to retained earnings at transition to be spread over 10 years for tax purposes.

General insurers are not expected to experience a significant impact from transitional earnings, so this transitional measure will not apply to them. The regulations will be put into law during the autumn, to apply to accounting periods beginning on, or after, 1 January 2023.