What are the requirements of the Task Force on Climate-related Financial Disclosures (TCFD)? We provide guidance on how Natural Resources businesses can apply this important framework and other best practice for effective reporting.

As concerns over climate change and sustainability increase, environmental disclosures have become a crucial tool for Natural Resources companies, investors and regulators to assess the impact of operations on the environment.

Natural Resources companies operate at the intersection of economic development and environmental stewardship. As global awareness of climate change and environmental degradation grows, these companies face more pressure to disclose their environmental impacts. Effective environmental disclosures not only fulfil regulatory requirements but also improve transparency and foster the trust of stakeholders.

What are environmental disclosures?

They refer to the practice of publicly sharing information about a company’s environmental policies, practices and performance, with a focus on climate-related risks and opportunities. This means stakeholders, including investors, regulators and the general public, can evaluate how a company addresses environmental challenges, such as greenhouse gas (GHG) emissions, waste management, water usage and energy efficiency.

The aims of the disclosures are to enhance transparency, reduce inconsistent information, and help stakeholders make informed decisions. Climate change has become a critical issue for the global economy, so Natural Resources businesses are increasingly expected to assess and communicate their environmental impact and risks.

What is the TCFD?

The Task Force on Climate-Related Financial Disclosures (TCFD) was established in 2015 by the Financial Stability Board (FSB) to develop a set of recommendations for voluntary and consistent climate-related financial risk disclosures across all industries. Its aim was to help companies provide transparent and consistent information to investors, lenders, and insurance underwriters about the financial impacts of climate change on their operations.

Mandatory reporting aligned to the TCFD framework applies to certain listed companies on the Main Market of the London Stock Exchange (LSE). This is on a ‘comply or explain’ basis and aims to foster a more sustainable economy and encourage investment in climate-resilient strategies.

Certain UK-incorporated companies and LLPs must also prepare climate-related financial disclosures. These were introduced into UK law but are predominately based on the TCFD framework. Some entities will be in scope of both regulations. Though there will be substantial crossover, there may be differences between the application of the UK Listing Rules (UKLR) and the UK company law requirements.

The TCFD framework is built around four key pillars:

- Governance: Organisations should disclose the governance structure in relation to climate-related risks and opportunities. This includes describing the Board’s oversight and the role of management. Strong governance ensures that climate risks are integrated into strategic decision-making.

- Strategy: Companies need to assess and disclose the actual and potential impacts of climate-related risks and opportunities on their business strategy, financial planning, and resilience. Understanding the effect their activities have on the climate helps companies adapt their strategies to remain competitive in a changing regulatory and economic environment.

- Risk management: Organisations should outline how they identify, assess, and manage climate-related risks. This includes the integration of these processes into their overall risk management frameworks. In turn, this means organisations are prepared for the potential financial consequences of climate-related events.

- Metrics and targets: Companies are encouraged to disclose the metrics used to assess climate-related risks and opportunities, including greenhouse gas (GHG) emissions, and to establish targets for reducing these emissions over time. The specific metrics and targets help organisations to measure progress and demonstrate commitment to managing climate-related risks.

Why are environmental disclosures so important?

Regulatory compliance

Natural Resources companies must follow certain environmental regulations that require transparency in their operations. Governments worldwide are implementing stricter regulations that oblige companies to disclose their environmental practices and impacts. Non-compliance can mean legal repercussions and the potential loss of operational licences.

Investor expectations

Investors are increasingly prioritising sustainability and responsible practices in their portfolios. Transparent environmental disclosures give them the critical information they need to assess risks and opportunities, making companies more attractive for investment. Reports that align with frameworks, like the TCFD and the Global Reporting Initiative (GRI), can signal a commitment to sustainability, helping companies attract socially conscious investors. The GRI is an international, independent standards organisation that helps businesses, governments and other organisations understand and communicate their impact on issues such as climate change, human rights and corruption.

Stakeholder trust

In an era of heightened awareness of climate change and environmental degradation, Natural Resources companies must build and maintain trust with various stakeholders, including local communities, NGOs, and governments. Comprehensive environmental disclosures demonstrate accountability and a commitment to responsible resource management, fostering better relationships and enhancing corporate reputation.

By promoting consistent and comparable climate-related disclosures, TCFD supports the transition to a low-carbon economy and encourages organisations to consider the long term impacts of climate change on their business models. What’s more, widespread adoption of TCFD recommendations will likely lead to increased investor confidence and drive capital towards more sustainable and resilient business practices.

What are the key areas of focus in the disclosures?

Emissions and climate impact

Natural Resources companies must disclose GHG emissions across their operations. These include direct emissions from owned or controlled sources and indirect emissions from the use of purchased electricity. Companies should provide detailed information on their carbon footprint, targets for emission reductions, and strategies to achieve these goals.

Water usage and management

Water is a critical resource for many Natural Resources industries, including mining, oil and gas, and agriculture. Companies should disclose their water usage, sources, and management practices, including efforts to minimise water consumption and prevent contamination. Transparency about water stewardship can mitigate risks related to water scarcity and regulatory scrutiny.

Biodiversity and land use

Natural resources extraction can significantly impact biodiversity and ecosystems. Companies need to assess and disclose their effects on local wildlife, habitats, and communities. This includes evaluating land use changes, habitat destruction, and measures taken to restore ecosystems. Reporting on biodiversity initiatives demonstrates a commitment to environmental stewardship and sustainability.

Waste management

Disclosures should also cover waste management practices, including the types of waste generated, recycling efforts, and plans for waste reduction. Companies should address how they handle hazardous materials and their strategies for minimising waste impacts on the environment.

UK Listing Rules and TCFD disclosures

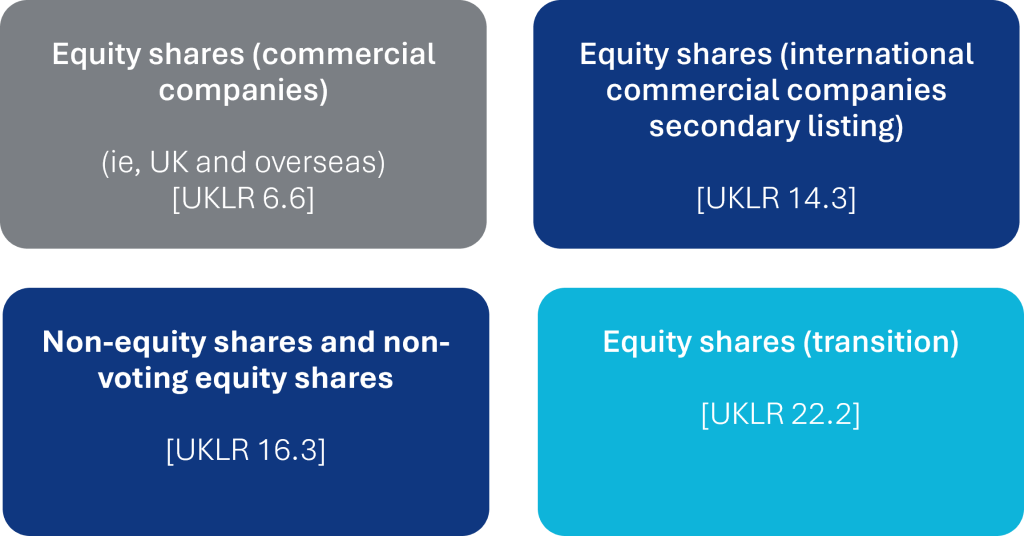

Not all companies listed on the LSE Main Market are required to apply the TCFD recommendations and produce TCFD-aligned disclosures in their annual report. The specifics depend on the category of listing under the UK Listing Rules (UKLR).

Listing categories

Per UKLR, the LSE Main Market companies below must provide TCFD-aligned disclosures in their annual report:

Investment entities and shell companies are exempt from complying with this requirement.

The following are mandatory for the companies outlined in the UKLR categories above. The checklist can be used as a guide for account preparers to ensure they have adhered to the requirements.

UKLR requirements

The annual report must include a statement setting out:

- Whether the company has included TCFD-aligned disclosures consistent with the TCFD’s reporting framework in its annual financial report

- Where some or all of the disclosures have been included in a document other than the annual financial report:

- Which recommendations and/or disclosures were included in that other document

- A description of that document and a reference to where it can be found

- An explanation of the reasons why those disclosures were included in that document, and not in the annual financial report.

- Where climate-related financial disclosures consistent with all of the TCFD recommendations have not been included in either the annual financial report or another document:

- The recommendations and/or recommended disclosures which have not been included

- An explanation of why the disclosures were not made

- A description of any steps being taken or planned to make consistent disclosures in the future, including relevant time frames.

- Where in the annual financial report or (as appropriate) other document, the climate-related financial disclosures referred to above can be found.

The UKLR extends to include TCFD sector-specific and other guidance by providing tailored advice for businesses across various industries. This ensures their climate-related financial disclosures are relevant and accurate. The Supplemental Guidance for the Non-Financial Sector under the TCFD framework provides guidance for sectors such as energy, transport, materials and buildings and agriculture which is relevant to Natural Resources companies.

Requirements under Companies Act 2006

The table below outlines the requirements applicable to companies that meet specific criteria:

Reference |

Applicable to |

Requirement |

|---|---|---|

Companies Act 2006 s414, 414CA and 414CB |

UK Public Entities (PIEs) with: o > 500 employees UK AIM companies with: o > 500 employees Other UK companies with: o > 500 employees and o > £500m turnover |

UK incorporated companies that exceed the relevant thresholds must report on the items listed below in their strategic

|

Source: TCFD reporting – PKF Corporate Reporting Helpsheet (September 2024)

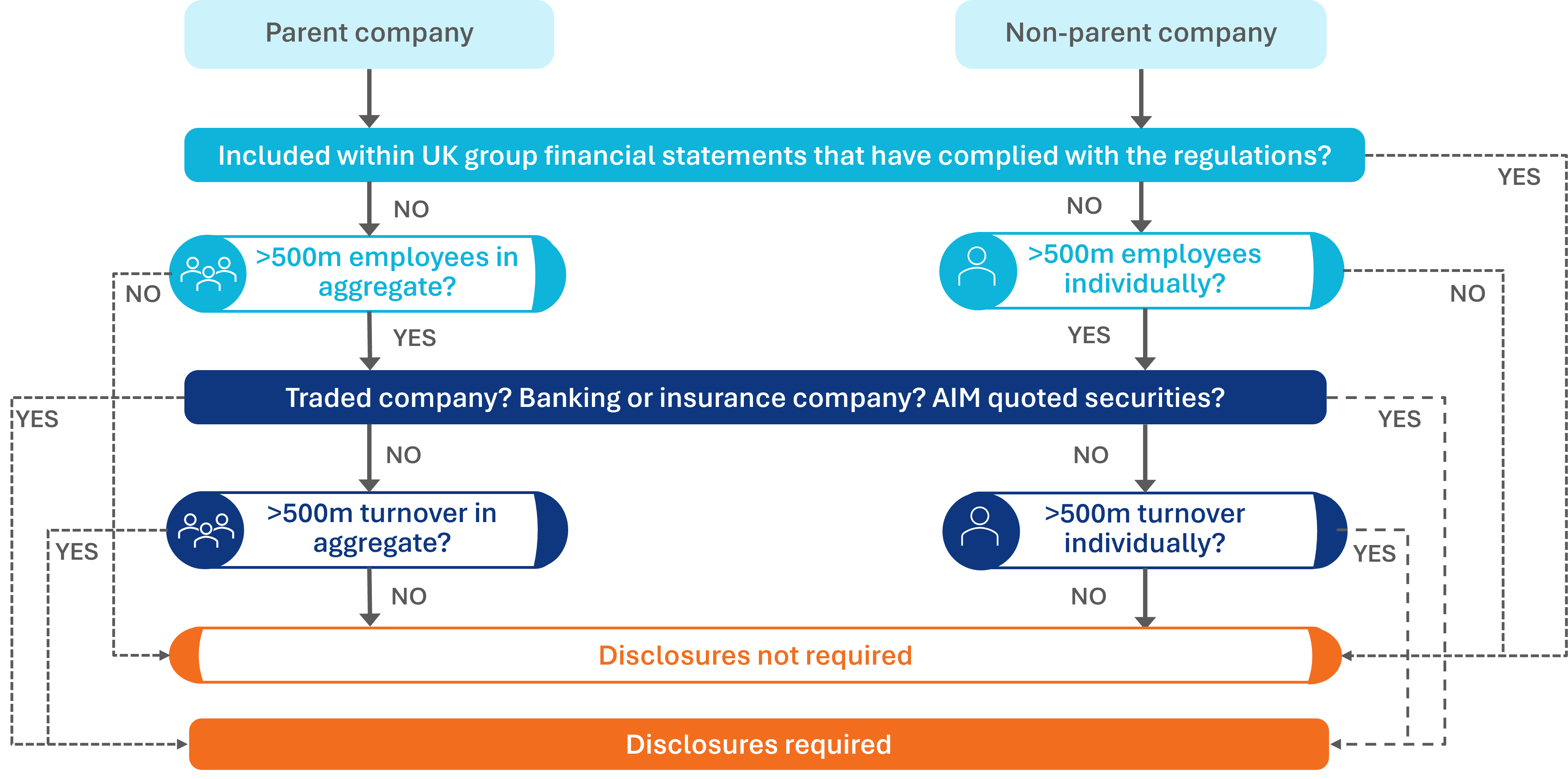

The decision tree below illustrates whether a UK company falls in scope of the CA 2006 regulations:

Source: TCFD reporting – PKF Corporate Reporting Helpsheet (September 2024)

Companies and LLPs will sometimes be required to comply with the requirements of both the UKLR and the climate-related financial disclosure requirements, as set out in the Companies Act 2006 (CA 2006).

The TCFD disclosure requirements under the UKLR are largely consistent with the CA 2006 regulations. The key similarities and differences are highlighted in the table below:

CA 2006 |

UKLR |

|---|---|

Differences |

|

Mandatory to apply all disclosure requirements. |

Applied on a ‘comply or explain’ basis. |

Disclosures must be included in the annual report (ie in a Non-Financial and Sustainability Information Statement (NFSI) within the strategic report). CA 2006 414CB (1) must contain the following information as a minimum: environmental matters, the company’s employees, social matters, respect for human rights, and anti-corruption and anti-bribery matters. |

Not prescriptive on the location of disclosures within the annual report, so allowing them to be presented in a different document (but a clear explanation of this and a cross-reference are required in the annual report). |

Scope 1, Scope 2 and Scope 3 greenhouse gas (GHG) emissions disclosure is not required. But there is a disclosure requirement under the Streamlined Energy Carbon Reporting (SECR) policy for organisations to share energy use and carbon emissions information in their annual reports. |

Scope 1 and Scope 2 disclosures required and |

Similarities |

|

Materiality: The general principle is that information is deemed to be material if its omission or misrepresentation could reasonably be expected to influence the economic decisions of users of the financial statements, taken on the basis of the annual report as a whole. |

|

Disclosure requirements: Apart from the GHG emission disclosure requirement, as above, the TCFD disclosure requirements of the CA 2006 and the TCFD recommended disclosures under the UKLR are highly consistent. |

|

What is best practice for effective environmental disclosures?

TCFD offers a comprehensive framework but, in order to make effective environmental disclosures, it is important to adhere to other best practice too. Here are some key recommendations based on insights from the FRC’s 2022 thematic review for organisations seeking to improve their climate-related reporting:

- Integrate climate risk into core strategy: Climate risks should not be treated as a separate entity from business strategy. Aligning climate risk assessments with overall corporate strategy ensures that climate change considerations are integrated into all facets of decision-making.

- Adopt a long-term perspective: Climate change is a long-term challenge, so businesses should look beyond immediate impacts. They should consider how evolving regulatory frameworks, stakeholder expectations and physical risks will impact their operations over the medium and long term.

- Perform scenario analysis: Scenario analysis is a key recommendation of TCFD. It involves assessing different potential future climate situations, such as a 2°C or 4°C warming scenario, to understand how they could affect the business. This helps companies prepare for a range of outcomes, and increases resilience.

- Develop clear, quantifiable metrics: Use specific, measurable, and comparable metrics to track climate-related risks and performance over time. Companies should focus on relevant data such as GHG emissions (Scope 1, 2, and 3), energy use, carbon intensity, water usage, and waste reduction targets.

- Enhance transparency: Transparency is critical for credibility. Companies should be open about their climate-related challenges, limitations, and trade-offs. They should disclose both their successes and areas where they need improvement.

- Engage stakeholders: It is crucial to involve key stakeholders, such as investors, regulators, customers, and suppliers in the environmental disclosure process. This can be done through regular dialogues, reports and surveys, ensuring that all stakeholders understand the company’s climate strategy.

- Seek external assurance: Independent verification or assurance of climate-related disclosures enhances credibility and ensures accuracy. External audits or reviews of climate data can provide stakeholders with greater confidence in the company’s reporting.

What are the challenges of implementation?

While the benefits of TCFD reporting are clear, organisations often face challenges in implementation:

- Data availability: Gathering relevant data on emissions and climate-related risks can be complex and resource-intensive, particularly for companies without existing frameworks.

- Integration into existing frameworks: Aligning TCFD recommendations with existing risk management and reporting frameworks may require significant adjustments in processes and policies.

- Capacity and expertise: Companies may lack the necessary expertise to analyse climate-related data and risks effectively, which could mean investment in training or external consultations. The use of external experts is highly recommended, and is normally the case for detailed disclosures.

Additional considerations

- Reporting frameworks: While TCFD does not mandate specific frameworks, companies are encouraged to align their disclosures with existing reporting standards, such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB).

- Frequency of reporting: TCFD recommends that disclosures be made on an annual basis, allowing stakeholders to track progress over time.

- Integration with financial reports: Organisations should aim to integrate TCFD disclosures with their mainstream financial reports, enhancing the relevance and accessibility of the information for investors.

Environmental disclosures are crucial for Natural Resources companies navigating the complexities of sustainability and regulatory compliance. By adopting best practice and aligning with TCFD recommendations, these companies can enhance their reputation, build trust with stakeholders, and position themselves for long-term success in a rapidly changing landscape.

As global awareness of environmental issues continues to grow, robust disclosures will become increasingly vital for demonstrating a commitment to responsible resource management and sustainable development.

If you would like further support on any of the issues raised in this article, please contact Imogen Massey, Elorm Numadzi, Jessica Wills or Charlie Benton.