Significant amendments to FRS 102 take effect for accounting periods beginning on or after 1 January 2026, aligning UK GAAP more closely with IFRS. Key changes include new models for revenue recognition and lease accounting, alongside other clarifications. Satya Beekarry explains how these changes will impact private equity managers and their portfolio companies.

Revenue recognition (Section 23 of FRS 102)

FRS 102 introduces a five-step model, broadly aligned with IFRS 15. The aim is for greater consistency and reliability in reporting revenue and cash flows arising from customer contracts. The changes will make revenue recognition more prescriptive, aiding comparability between FRS 102 and other standards.

The five steps are:

1) Identify the contract(s) with a customer,

2) Identify the performance obligations in the contract,

3) Determine the transaction price,

4) Allocate the transaction price to the performance obligations,

5) Recognise revenue when (or as) performance obligations are satisfied.

For private equity managers, this has the potential to have a significant impact given the range of services offered. Investment management fees, fund admin fees, deal fees, monitoring fees, and performance fees (carried interest) can all be captured.

While the total revenue recognised may not change, timing could accelerate or decelerate, particularly during transition. Judgment will be critical in identifying distinct performance obligations and determining the period over which benefits are delivered.

Lease accounting (Section 20 of FRS 102)

The FRC has overhauled lease accounting aligning FRS 102 more closely with IFRS 16.

This change marks a significant shift for UK entities, as it eliminates the traditional distinction between operating and finance leases for lessees. Whilst the requirements for lessors have also been rewritten, these will not differ significantly from current practice.

The key changes for lessees are:

- No longer a distinction between operating and finance leases

- Lessees are required to recognise a right-of use asset and a corresponding lease liability (similar to the existing finance lease accounting) on the balance sheet

- Recognition exemptions allow short-term leases and leases of low-value assets to remain off balance sheet

- Judgement may be required to be applied regarding determination of low value assets and lease term

- Introduces additional complexity and judgements, as lease terms such as extension and termination clauses need to be understood

- Additional disclosure requirements.

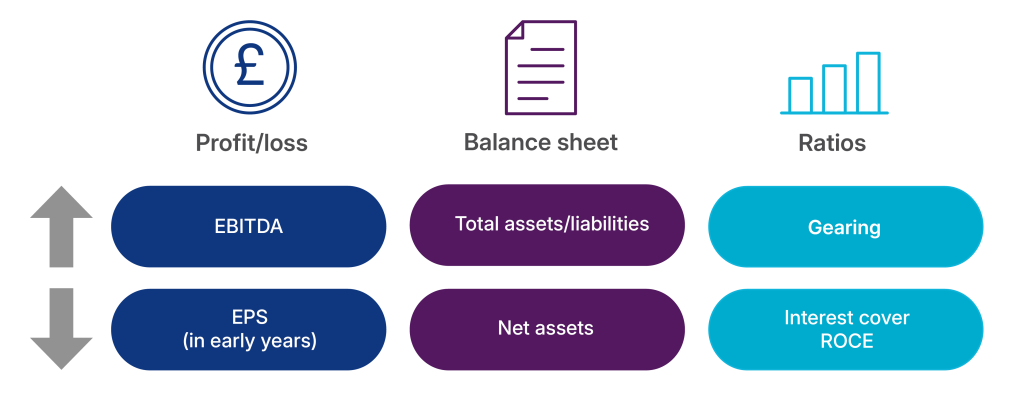

In practice, most material leases will move on balance sheet, front-loading lease expenses compared to today’s straight-line approach. Both assets and liabilities will increase initially, but mismatches over time will reduce net assets.

Current ratios may be adversely impacted on transition due to balance sheet gross-up. The IFRS 16 definition of a lease may capture contracts previously excluded, such as intra-group arrangements, creating new leases and sub-leases and adding complexity.

Impact on performance and valuation of portfolio companies

These changes affect profit margins, reward schemes and dividend capacity for houses and portfolio companies.

EBITDA will rise as rent costs shift from operating expenses to depreciation and finance charges, impacting performance metrics and comparability across periods. Debt covenant compliance should be revisited, as metrics may change under the new standards.

Major client agreements should be reviewed to identify performance obligations and assess timing impacts.

In the transition stage, continued monitoring and engagement with portfolio company management to assess implications on financial position will be essential, particularly for businesses preparing for investment or exit.

From a valuation perspective, changes to accounting treatment are unlikely to alter the overall value of a portfolio asset. However, they will affect the underlying valuation mechanics.

For those applying a multiples-based methodology, adjustments to revenue and EBITDA are expected to drive a step change in the multiples used.

On a positive note, greater alignment with IFRS should enhance comparability within peer groups and improve the consistency of comparable baskets.

How can we help

Our accounting advisory team can support impact assessment, implementation, and transition to the amended FRS 102 standards. With experience in IFRS 15 and IFRS 16 transitions, we understand the challenges these changes pose. Please contact us to discuss this or any other upcoming standard amendments further.

If you have any questions about the topics discussed in this article, please feel free to contact Satya Beekarry or Michael Marslin.