As 2025 draws to a close Partner, Ben Pott reflects on a year in Global Private Equity of quality over quantity in dealmaking, creative structures unlocking exits, and persistent fundraising challenges. Exploring four themes that are shaping the industry – Deal Activity, Exit Dynamics, Fundraising Trends, and Strategic Initiatives – Ben shares his outlook for 2026.

Deal activity

2025 marked a year of divergence between deal value and volume. Total deal value reached $1.5tn across buyouts, add-ons, and expansion deals, with Q3 contributing over $500bn, the strongest quarter in three years. Yet volumes softened year-on-year and remain well below 2021 peaks, signalling a preference for fewer, higher-quality deals. This trend was characterised by three major U.S. public-to-private buyouts contributing $95bn of Q3’s value; Electronic Arts ($55bn), Air Lease ($28.2bn), Dayforce ($12.3bn).

The valuation gaps which have impeded recent dealmaking began to narrow, with two-thirds of GPs reporting improved alignment. Creativity in deal structures grew, with club deals and co-investments rising for risk-sharing and value creation. Cross-border activity gained traction, particularly in Asia-Pacific and Europe, as firms sought geographic diversification in sourcing quality assets.

Global Private Equity deal activity (buyout, add-on & PE growth)

Source: PitchBook Data, Inc.

Exit dynamics

The paradox of abundant capital versus exit scarcity, a defining trend in recent years, persisted. Dry powder hit $1.2tn, with nearly a quarter held for over four years, yet Q1 exits were the lowest in two years. However, a rebound in Q3 suggests this imbalance may be easing.

Liquidity pressures from LPs fuelled growth in continuation funds and secondaries, enabling GPs to extend trophy asset ownership and improve DPI. For more traditional exits, a rise in earnouts and contingent clauses were utilised to mitigate macro uncertainty. Encouragingly, PE-backed IPOs re-emerged after years of hibernation, raising $18bn in Q3, led by healthcare and financial infrastructure listings.

Global PE exit activity

Source: PitchBook Data, Inc.

Fundraising trends

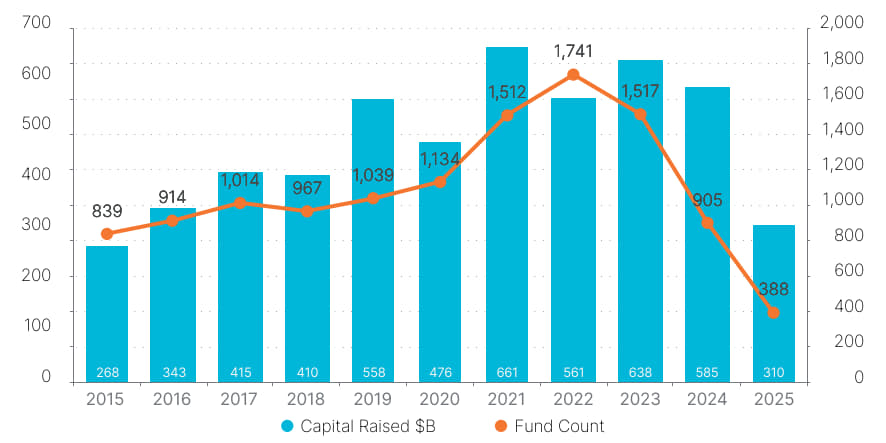

Fundraising remained subdued at $340bn raised YTD, down 25% year-on-year. Buyouts continued to dominate, while secondaries gained momentum. Timelines stretched to 17–25 months as LPs exercised caution navigating liquidity constraints and rebalancing efforts. Retail channels and U.S. 401(k) access emerged as long-term tailwinds, with estimates citing that a modest allocation could increase incremental capital flows by over $500bn. Demand for semi-liquid evergreen structures grew; historically offered by larger firms they look poised to become more mainstream as GPs aim to provide flexibility in a competitive environment.

Global PE fundraising activity

Source: PitchBook Data, Inc.

Strategic initiatives

AI continued to transform PE strategies, from deal sourcing to portfolio optimisation. Firms embedded AI in pricing, GTM strategies, and operational planning, enhancing due diligence and performance tracking.

ESG priorities diverged geographically: while the U.S. scaled back, Europe and Asia maintained ESG as a core value driver. ESG-focused deals surged in renewables, healthcare, and clean tech, supported by regulatory and stakeholder pressures for robust frameworks.

Operational value creation shifted toward “operational alpha”, leveraging data-driven approaches, predictive analytics, and lean models to drive EBITDA growth. Relying on financial engineering alone, through leverage and multiple arbitrage, is no longer sufficient. Current value creation hinges on innovation, disciplined execution and measurable operational impact.

Outlook for 2026

As we race towards 2026, market sentiment leans toward cautious optimism. Deal-making momentum should continue, supported by IPO resurgence, easing financing conditions, and narrowing valuation gaps. AI adoption will move from experimentation to full-scale deployment, reshaping strategy and portfolio operations.

Challenges will remain, particularly for those raising capital. The trend for funds flowing to the largest, most experienced funds is not expected to reverse. Mid-market players will need to be innovative in their product offering to stand out in an increasingly competitive, investor-led fundraising landscape.

Whilst pre-2022 levels of deal activity are not yet predicted to return, Private Equity is showing signs of weathering the storm of the last three years. Macro volatility remains a threat to PE’s positive momentum but Vanguard’s recent long-term analysis suggesting a diversified PE portfolio can outperform global public equities by 3.5% annually reinforces the asset class’s resilience and appeal to investors.

If you have any questions about the topics discussed in this article, please feel free to contact Ben Pott.