Though they bring many benefits, classification and valuation of convertible loans can be a minefield. We provide a step-by-step guide to what companies need to consider.

Convertible notes are a common financing tool for entities seeking to fund their operations.

A company issues debt to an investor with the option of converting this into equity, usually subject to certain conditions being met.

This gives investors a share in potential equity growth. It also often provides a cash settlement option to protect against downside risks when the conversion is ‘out of the money’.

What are the benefits?

For companies there are several key reasons for issuing convertible loans instead of following the traditional equity/debt route:

- Flexible financing option

Convertible notes allow companies, especially those in the start-up or early stage, to raise funding without immediately determining a valuation. We often see these transactions in cash shells, exploration entities and early-stage development companies, where the company’s value is expected to increase in the future as the company develops. So there is a built-in incentive to the investor within the conversion element of the convertible note.

- Deferred equity dilution

Instead of issuing shares right away, the company delays equity dilution. The loan converts into equity later, typically during a future funding round. This is often at a discount or with a valuation cap, and therefore maintains value to shareholders.

- Speed and reduced upfront costs

Convertible notes are generally quicker and cheaper to issue than equity financing. They require less mediation and legal complexity, making them ideal for fast-moving funding rounds.

What are the accounting requirements?

Accounting for convertible notes is a challenging technical process. Because of the complex standard, the variability between agreements, niche terms and required valuation approaches, we often find errors in the classification and valuation of these notes.

Classification

The standard says a convertible instrument is treated as having two components:

- a liability host

- a conversion feature, which may or may not qualify as equity.

If there are multiple components, they should be analysed individually to decide how to classify them.

Where an entity has a contractual obligation that will or may require settlement in the entity’s own equity instruments, the liability classification requirements are different for non-derivatives and derivatives. These are split as follows:

- Non-derivative contracts that involve delivering a variable number of shares are classified as financial liabilities. That’s because the company doesn’t have control over the number of shares it will issue

- Derivative contracts (such as conversion options in convertible notes) are classified as financial liabilities unless they meet the ‘fixed-for-fixed criterion’ under IAS 32. If not, they are treated as derivative liabilities.

On the other hand, equity instruments are those where the issuer is not obliged to deliver cash or another financial asset, and the settlement involves issuing a fixed number of shares for a fixed amount of cash (referred to as the fixed-for-fixed criterion we mentioned above).

Conversion features in convertible notes (which are often derivatives) can only be classified as equity if they meet the fixed-for-fixed criterion. If not, they are considered derivative liabilities.

Convertible into a fixed number of shares

Example 1: A UK-based company, Entity A, issues a £1,000 convertible note to fund the development of a new project. The note has a three-year maturity and pays a 10% annual coupon. At maturity, the holder can either receive £1,000 in cash or convert the note into 5,000 shares of Entity A. The market interest rate for a similar non-convertible note would have been 12%. Entity A also incurred £100 in transaction costs.

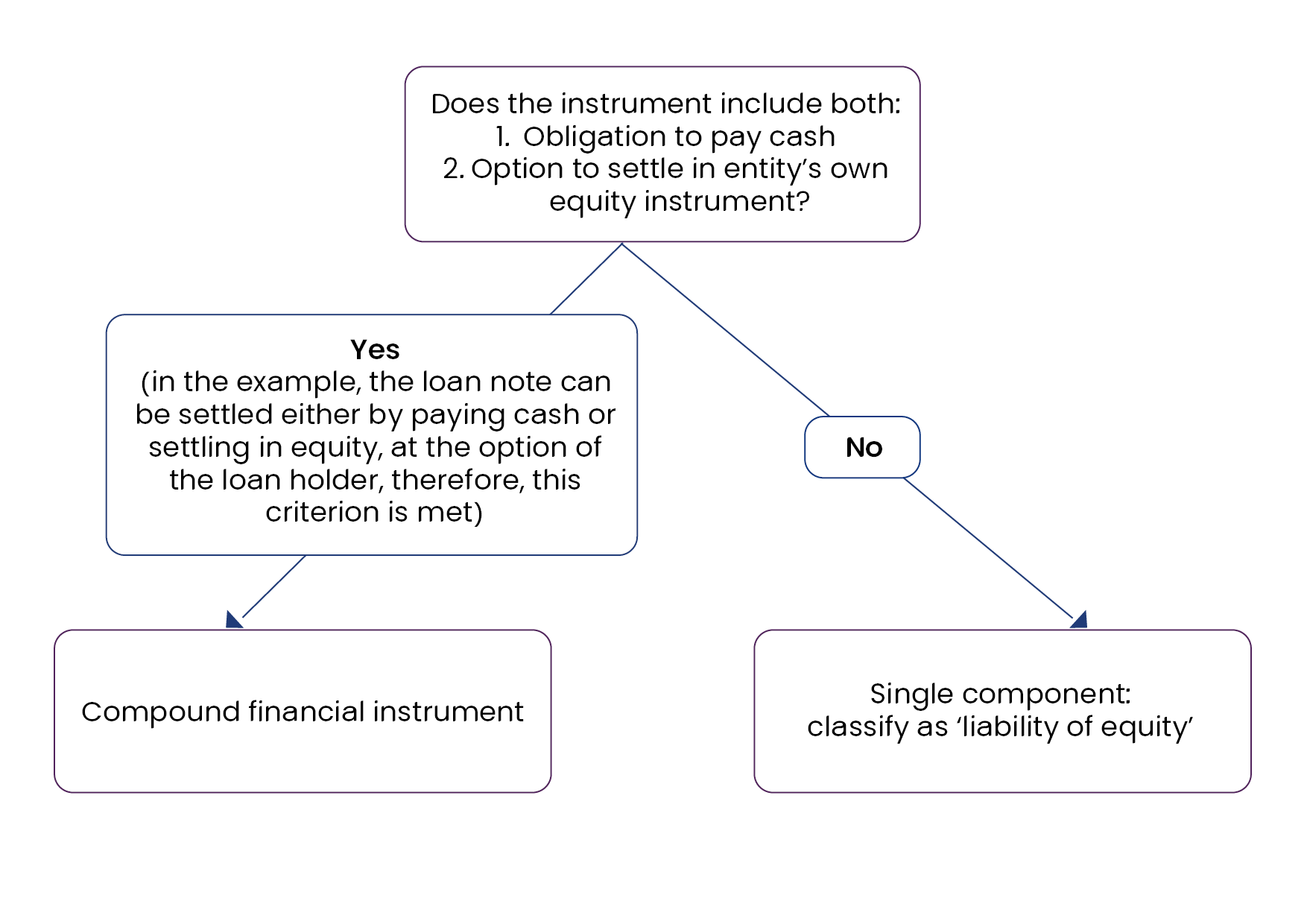

Step 1: Identifying the instrument

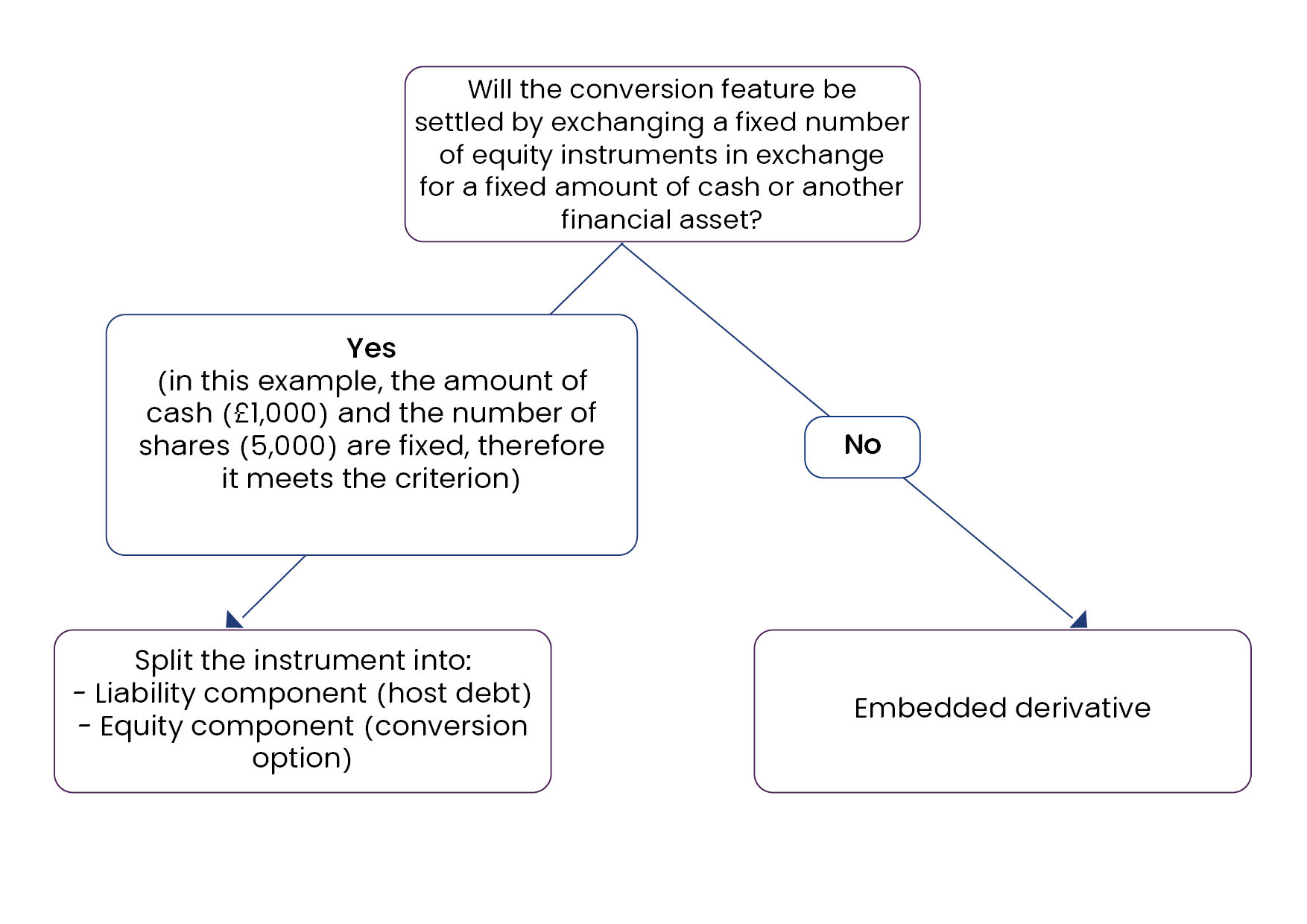

Step 2: Assessing fixed-for-fixed criterion

To summarise, the loan is classified as a compound financial instrument with two components:

– Liability component: the obligation to pay the 10% annual coupon and the £1,000 principal is classified as a liability because Entity A has a contractual obligation to deliver cash.

– Equity component: the option to convert the £1,000 into 5,000 shares is classified as equity since it meets the ‘fixed-for-fixed’ criterion’ (a fixed amount of cash is exchanged for a fixed number of shares).

Convertible into a variable number of shares

Example 2: Entity B, another UK company, issues a £1,000 convertible note. The note matures in three years, pays a 10% annual coupon, and allows the holder to convert the note into shares of Entity B. The conversion price is variable, based on the lowest 5-day average share price in the 30 days before conversion. Transaction costs of £100 were incurred.

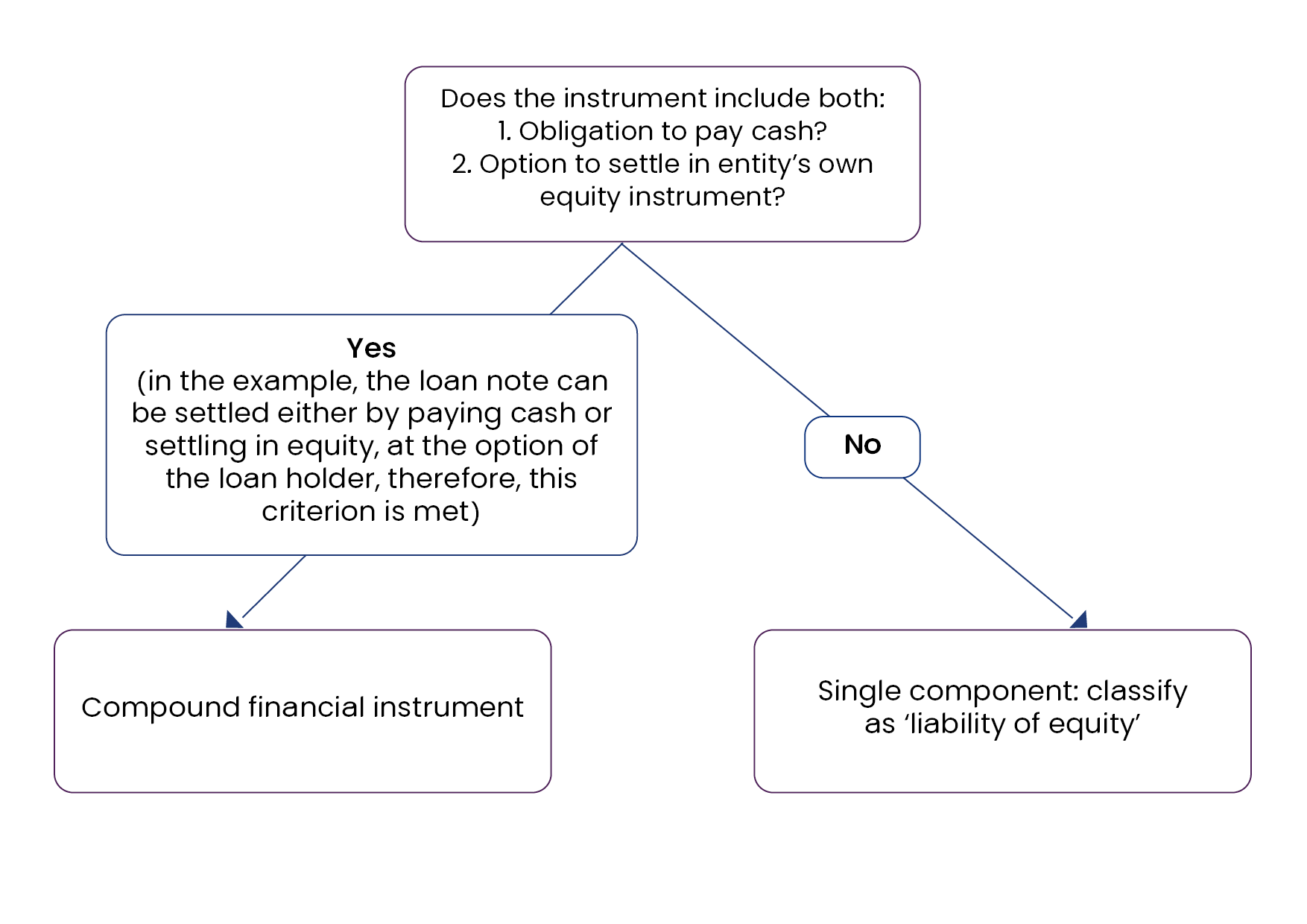

Step 1: Identifying the instrument

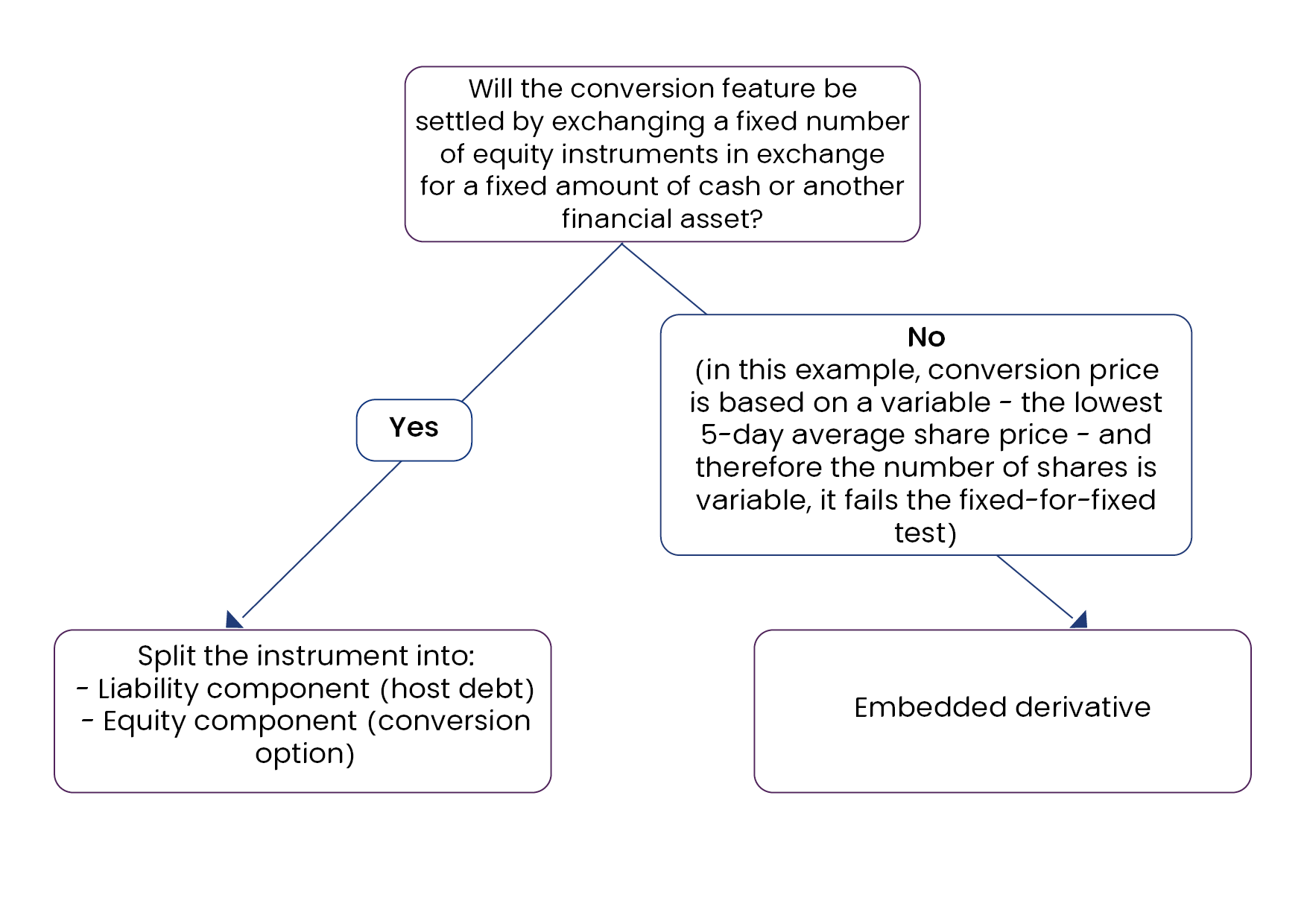

Step 2: Assessing fixed-for-fixed criterion

To summarise, the above convertible note contains two components:

- Liability component: the cash repayment of the £1,000 principal and coupon payments is classified as a liability.

- Derivative liability component: the conversion option, because it is settled with a variable number of shares – conversion price is based on a variable – the lowest 5-day average share price, which fails the fixed-for-fixed criterion. So the conversion option is classified as a derivative liability rather than equity.

Measurement principles

After deciding the classification of the financial instrument components, the next step is to measure each part.

- Compound financial instrument

For a convertible instrument classified as having both a liability and an equity component, the liability is measured first. This is done by calculating the present value of future cash flows, discounted using the interest rate applicable to an equivalent instrument without the conversion feature (ie a standard loan).

The equity component is the residual value, calculated by subtracting the liability value from the total fair value of the instrument. This approach aligns with the definition of equity as a residual interest.

In most cases, the fair value of the instrument at initial recognition is the transaction price. But if it is quoted in an active market, or issued for non-monetary consideration, then the fair value of the whole instrument may need to be worked out. After initial recognition, the liability is measured at amortised cost, while the equity component is not remeasured.

In Example 1 above, the liability component is initially measured at the present value of the future cash flows, discounted using the market interest rate of 12% (the rate applicable to a non-convertible instrument). The equity component is measured as the residual amount, calculated by deducting the liability’s fair value from the total transaction price (£1,000).

- Convertible note with embedded derivative liability

When a convertible note has a conversion feature classified as a derivative liability, this is accounted for separately from the host instrument under IFRS 9. This applies when the economic characteristics of the embedded derivative differ significantly from those of the host debt instrument. Then the derivative must be separated, unless the entire instrument is measured at fair value through profit or loss (FVTPL). In this case, the derivative’s fair value is calculated first, with the remaining value assigned to the liability component.

After initial recognition, the derivative liability is measured at fair value through profit or loss, while the host liability is accounted for at amortised cost. Alternatively, under IFRS 9, an entity can choose the fair value option to account for the entire contract at fair value. This simplifies the accounting process but potentially increases volatility in reported profit or loss because of changes in factors like interest rates or the issuer’s credit rating.

In Example 2 above, the conversion feature is classified as a derivative component. It is measured first at its fair value, with the residual value allocated to the host liability. The instrument is subsequently remeasured at fair value at each reporting date.

Should you consider the involvement of valuation experts?

Identifying and measuring the derivative component of a convertible note is usually highly complex. These components are often linked to variables such as share price volatility, foreign exchange movements, and non-standard conversion features, such as down-round protection, caps or floors. All this means they typically require advanced valuation techniques such as Monte Carlo simulations or option pricing models.

These models incorporate a range of inputs, including:

- share price volatility

- risk-free interest rates

- expected life of the instrument

- conversion terms and conditions

- embedded features like anti-dilution clauses.

Given the technical nature of these valuations, we strongly recommend that entities engage qualified valuation experts early in the process. Ideally, this should be at the time the instrument is issued.

As auditors, one of the most common and critical issues we encounter is the misclassification of convertible instruments or lack of involvement of valuation specialists. This can lead to material errors in the financial statements or delays in reporting.

Our valuations team has significant expertise in determining both the classification and the valuation of complex convertible notes. To find out more about how we could support you, please contact Cheryl Court or Lakshmi Upadhyaya.