As sustainability becomes a central theme in corporate strategy, green loans, loans that contain environmental, social, or governance (ESG) targets, are gaining prominence. While these instruments are structurally like traditional loans, their accounting treatment may involve additional considerations, especially around disclosures and embedded terms linked to sustainability performance.

What are green loans?

Sustainability-linked loans are debt instruments where the interest rate is tied to specific ESG performance indicators. This means the loan’s cash flows can fluctuate based on how well the borrower meets certain ESG targets. For example, the interest rate might decrease if the borrower reduces greenhouse gas emissions by a set percentage. These are often referred to as ‘green loans’.

Examples of green measures, sometimes referred to as ‘green variability’ include measures relating to:

- energy efficiency metrics

- energy consumption standards relating to the asset being financed

- diversity related targets such as gender representation

- emissions or waste regulatory standards, or

- a sustainability index that measures the performance of an entity based on a collection of different green measures.

Sustainability-linked loans carry accounting implications for both lenders and borrowers, each facing distinct considerations under the relevant financial reporting standards.

Green loans may also refer to loans granted to finance activities that are ‘green’, ie loans to build solar or wind infrastructure. Typically, these loans do not necessarily include terms which can cause their contractual cash flows to change with sustainability-linked targets and are generally similar to plain vanilla loans.

Accounting under IFRS

In practice, the terms of sustainability-linked loans can differ significantly between instruments, and applying the requirements of IFRS 9 often involves considerable judgment. This is especially true for lenders, where accounting approaches are still evolving as the market matures.

Lender’s accounting

A key challenge with sustainability-linked loans lies in determining whether the contractual cash flows qualify as ‘solely payments of principal and interest’, commonly known as the SPPI test. This assessment is critical, as it dictates whether the loan can be measured at amortised cost or at fair value through other comprehensive income (FVOCI). If the SPPI criteria are not met, the loan must instead be measured at fair value through profit or loss (FVTPL), which can significantly affect reported earnings.

To date practice has been mixed, and there has been limited guidance to determine whether ESG features cause an instrument to fail the SPPI test. As a result, in May 2024 the IASB issued targeted amendments to IFRS 9, including amendments that impact loans containing ESG targets. The new requirements have been endorsed by the UK Endorsement Board and will apply to accounting periods beginning on or after 1 January 2026, but can also be early adopted.

For those entities that do not early adopt it is important to consider whether the features provide commensurate compensation for basic lending risks, such as credit risk, or whether the features introduce compensation for new risks that are inconsistent with basic lending arrangements. Some features may be de minimis or non-genuine, and non-genuine is difficult to prove. To determine whether loans with green measures satisfy the SPPI test, it will be necessary to apply judgement, and the contractual terms will need to be carefully assessed.

Amendments to IFRS 9

The amendments introduce specific guidance that may result in differences in the accounting for existing arrangements, and therefore preparers should reassess any existing arrangements against the new criteria when adopting the amendments.

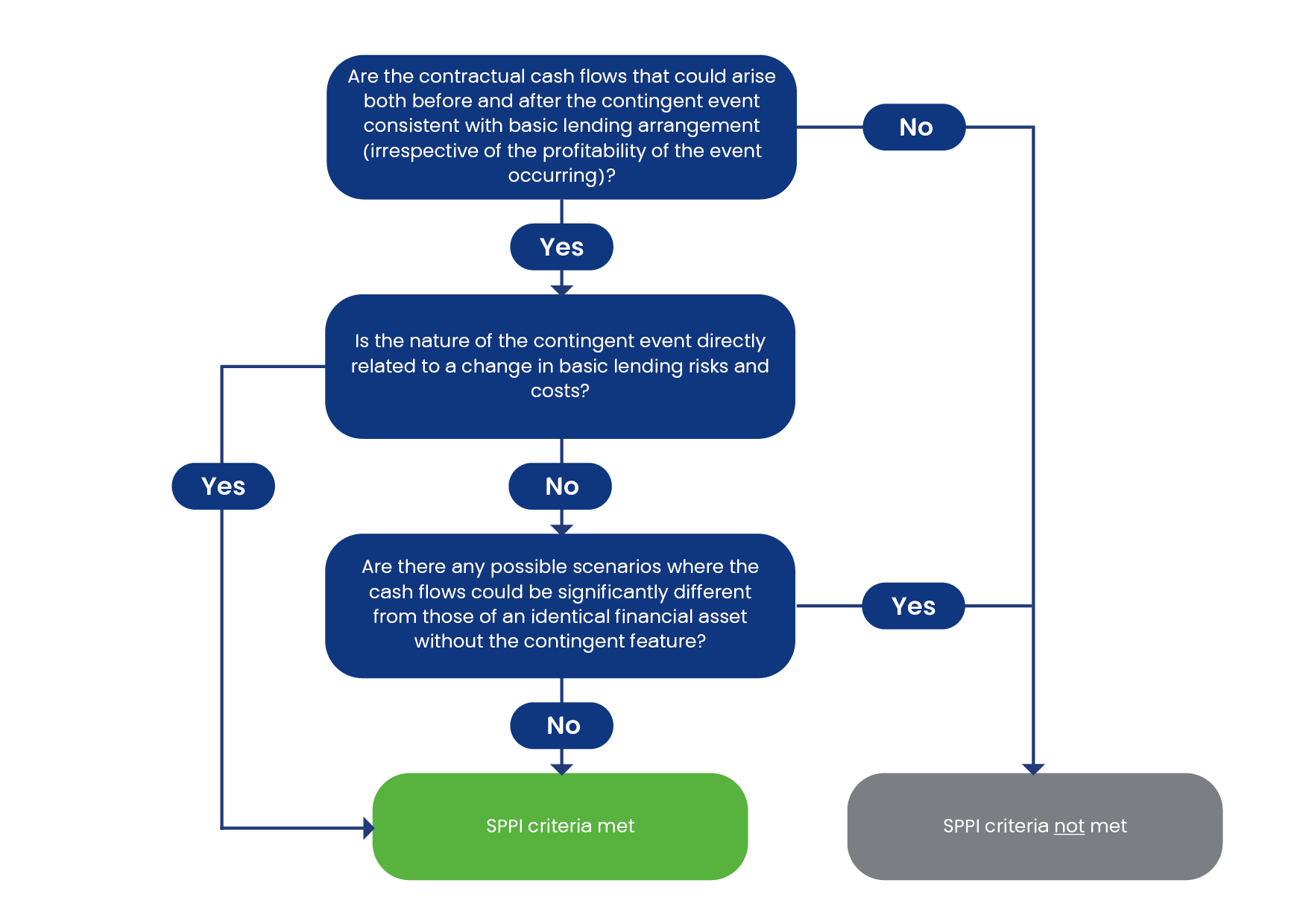

The amendments provide additional guidance on the SPPI assessment and can be summarised in the following decision tree:

The amendments also provide the following examples to illustrate cash flows that are SPPI and are not SPPI.

Illustration 1 – IFRS 9 para B4.1.13 – SPPI cash flows 1.

A lender issues a loan with an interest rate that is adjusted every reporting period by a fixed number of basis points if the debtor achieves a contractually specified reduction in carbon emissions during the preceding reporting period. The maximum possible cumulative adjustments would not significantly change the interest rate on the loan.

Analysis

The contractual cash flows are solely payments of principal and interest on the principal amount outstanding. The entity considers whether the contractual cash flows that could arise both before and after each change in contractual cash flows are solely payments of principal and interest [IFRS 9 para B4.1.10 2].

If the contingent event of achieving the carbon emissions target occurs, the interest rate is adjusted by a fixed number of basis points, resulting in contractual cash flows that are consistent with a basic lending arrangement. It is only because the nature of the contingent event itself does not relate directly to changes in basic lending risks and costs that the entity cannot conclude – without further assessment – whether the cash flows on the financial asset are solely payments of principal and interest.

The lender therefore assesses whether, in all contractually possible scenarios, the contractual cash flows would not be significantly different from the contractual cash flows on a financial instrument with identical contractual terms, but without the contingent feature linked to carbon emissions [IFRS 9 para B4.1.10A3]. Because any adjustments over the life of the instrument would not result in contractual cash flows that are significantly different, the lender concludes that the loan has contractual cash flows that are solely payments of principal and interest on the principal amount outstanding.

Illustration 2 – IFRS 9 B4.1.14 – Not SPPI cash flows4

A lender issues a loan with an interest rate that is adjusted every reporting period to track the movements in a market-determined carbon price index during the preceding reporting period.

The contractual cash flows are not solely payments of principal and interest on the principal amount outstanding. The contractual cash flows are indexed to a variable (the carbon price index), which is not a basic lending risk or cost. The contractual cash flows are therefore inconsistent with a basic lending arrangement [IFRS 9 para B4.1.8A5].

FRS 102

FRS 102 Sections 11 and 12 do not explicitly address sustainability-linked features. Most sustainability linked loans may meet the criteria in Section 11 to be accounted for as a basic financial instrument at amortised cost. If the sustainability-linked features significantly alter the cash flows or risk profile, then the loan would be required to be accounted as a non-basic financial instrument under Section 12 and measured at fair value through profit and loss.

Borrower’s Accounting

From the borrower’s perspective, whether the sustainability-linked loans are accounted for under IFRS or FRS 102, the key considerations are whether the green features in the loan give rise to an embedded derivative. Under IFRS if an embedded derivative is identified it is necessary to consider whether the derivative should be accounted for separately from the loan. Under FRS 102, derivatives are generally accounted for separately from the host contract, unless they are closely related to the host contract and the entire instrument qualifies as a basic financial instrument.

In addition, borrowers should be aware that there are hedging considerations if the borrower enters into swaps to hedge the sustainability-linked exposure on loans.

Conclusion

As sustainability-linked loans become more prevalent in the financial landscape, their accounting treatment under both IFRS and FRS 102 demands careful consideration. IFRS 9 provides a structured framework, enhanced by recent amendment, to assess whether such instruments meet the SPPI criteria for lenders. Judgement will need to be exercised when reassessing existing loans. Under FRS 102, the absence of explicit guidance means entities must rely on the principles in Sections 11 and 12, with a focus on whether the loan remains a basic financial instrument or requires fair value treatment.

For borrowers, the presence of embedded derivatives, the nature of ESG targets, and the potential impact on cash flows are critical factors in determining the appropriate accounting approach.

As regulatory expectations and market practices evolve, staying informed and reassessing existing arrangements will be essential to ensure accurate and transparent financial reporting.

How PKF can help

Navigating the complexities of accounting for sustainability-linked loans requires deep technical expertise and up-to-date knowledge of evolving standards. Our Financial Accounting Advisory (FAAS) team offers tailored support to help clients:

- Assess SPPI compliance under IFRS 9, including the impact of recent amendments.

- Evaluate embedded derivatives and determine appropriate accounting treatments under both IFRS and FRS 102.

- Reassess existing loan arrangements in light of new guidance and market developments.

- Develop robust disclosure strategies aligned with ESG-linked financial instruments.

Whether you’re a lender or borrower, our FAAS specialists can guide you through the challenges of green finance reporting with clarity and confidence.

References:

1 Exposure Draft: Amendments to the Classification and Measurement of Financial Instruments – page 13 para B4.1.13 (SPPI cash flows)

2Exposure Draft: Amendments to the Classification and Measurement of Financial Instruments – page 13 para B4.1.10

3 Exposure Draft: Amendments to the Classification and Measurement of Financial Instruments – page 13 para B4.1.10A

4 Exposure Draft: Amendments to the Classification and Measurement of Financial Instruments – page 14 para B4.1.14 (Not SPPI cash flows)

5 Exposure Draft: Amendments to the Classification and Measurement of Financial Instruments – page 12 para B4.1.8A