Find out if CSRD applies to your company. If so, we provide an in-depth guide to help you navigate the complexities of implementing the requirements.

The Corporate Sustainability Reporting Directive (CSRD) is an EU directive that affects large and listed companies both inside and outside the EU. It mandates comprehensive reporting on how companies monitor and report their environmental (E), social (S) and governance (G) sustainability matters.

The scope is particularly complex for group structures with parent companies outside the EU.

What are the origins and objectives of CSRD?

Approved in 2020, the European Green Deal had three main goals: to make Europe the first climate-neutral continent by 2050; to reduce net greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels; and to plant three billion additional trees in the EU by 2030.

As part of this initiative, the European Commission adopted CSRD in April 2021. It was one of the legislative acts to improve the transparency, consistency and quality of sustainability reporting.

The directive requires the use of European Sustainability Reporting Standards (ESRS), developed by the European Financial Reporting Advisory Group (EFRAG). These standards significantly expand the scope and depth of sustainability reporting, with over 1,000 ESG data points in total.

The new directive came into force in January 2023, replacing the existing Non-Financial Reporting Directive (NFRD). But not all EU member states have incorporated this directive into national law, despite the July 2024 deadline.

Who is required to report?

The CSRD, compared to NFRD, impacts a larger number of companies. Determining whether and when your company needs to comply with CSRD is not straightforward. The directive’s implementation is phased over several years, based on a company’s key characteristics, as follows:

Phase-in of CSRD reporting

| Period commencing on/or after | Reporting in | Companies in scope |

| 1 January 2024 | 2025 | Large EU PIEs with >500 employees, companies with debt or equity listed on EU regulated market (ie companies previously subject to the NFRD). |

| 1 January 2025 | 2026 | Large EU companies / groups meeting certain balance sheet / turnover / employee number criteria (see table below). |

| 1 January 2026 | 2027 | SMEs (excluding micro-entities) with debt or equity listed on EU regulated market, small and non-complex credit institutions, and captive insurance and reinsurance undertakings. A transitional two-year opt-out option is available for listed SMEs. |

| 1 January 2028 | 2029 | Non-EU companies generating a least €150m net turnover in EU and with at least one branch with €40m net turnover in EU OR at least one large or SME subsidiary with debt or equity listed on EU regulated market. |

Note: These dates are subject to change (see Current and future developments for CSRD section below).

High-level CSRD scoping

| All EU companies or EU companies that are a parent of a large group (EU subgroup) exceeding two of the three criteria on two consecutive annual balance sheet dates | >250 employees during the financial year |

| >€25m balance sheet | |

| >€50m net turnover | |

| Non-EU companies generating annual EU revenues over €150m in two most recent years and one of two criteria is met | An EU subsidiary meeting the criteria above |

| EU branch with €40m in revenue |

Note: These thresholds are subject to change (see Current and future developments for CSRD section below).

While the above shows comprehensive criteria for determining if your company falls into scope, there are exemptions for an in-scope EU subsidiary or EU subgroup. This is where the EU or non-EU parent produces a consolidated report in compliance with the CSRD. Given the detailed nature of assessment, some companies, especially those with complex group structures, have considered using parent or group consolidated or combined reporting.

What are the compliance challenges?

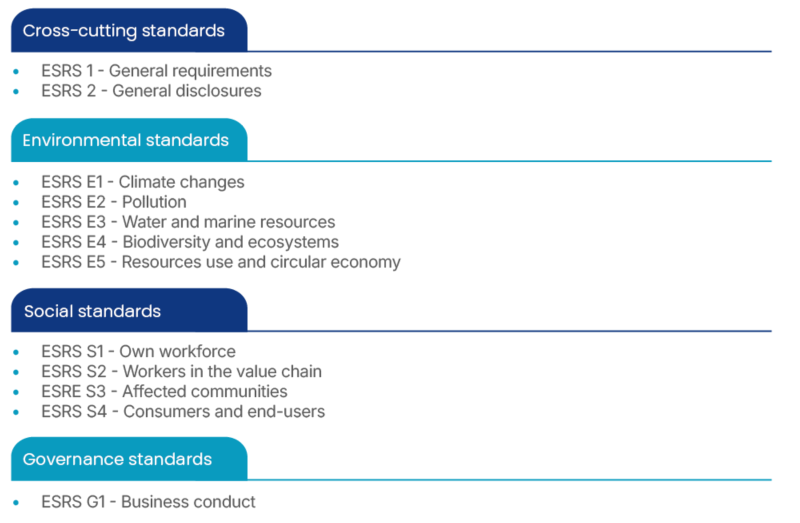

Companies in the scope of the CSRD must present a sustainability statement in their annual report in line with the relevant ESRSs. The ESRSs include two cross-cutting standards and 10 topical standards.

Below is a summary of the draft framework:

The starting point for determining which ESRSs a company needs to report on is the double materiality assessment (DMA) process. This identifies the material impacts, risks, and opportunities (IROs) relating to sustainability matters and the applicable ESRSs. Regardless of the DMA, the cross-cutting standards in ESRS 1 and ESRS 2 are mandatory for all companies.

There are three categories of ESRS:

- Cross-cutting standards

- ESRS 1 General requirements – describes the architecture of the ESRS, explaining drafting conventions and fundamental concepts and setting out general requirements for preparing and presenting sustainability-related information.

- ESRS 2 General disclosures – establishes disclosure requirements on the information to be provided, at a general level, across all material sustainability matters on the reporting areas of:

- governance

- strategy

- impact

- risk and opportunity management

- policies and actions

- metrics and targets.

- ESRS 1 General requirements – describes the architecture of the ESRS, explaining drafting conventions and fundamental concepts and setting out general requirements for preparing and presenting sustainability-related information.

- Topical standards

These cover various ESG topics and are structured into 10 topical standards. The topics are then split into sub-topics and sub-sub-topics. Each topical standard provides specific disclosure requirements and data points. Topical standards are only required to be reported if the topics they cover are material to the company.

In addition, companies must determine and report on any material entity-specific topics. To help with these disclosures, companies can consider the information required under topical ESRS that addresses similar sustainability matters. There are also some transitional provisions for entity-specific disclosures in the first three years of reporting.

How do companies identify relevant topical standards?

The ESRS addresses a broad range of ESG matters. But only those that present material IROs must be included in the sustainability statement. This is where the DMA comes into play in your assessment.

Other sustainability standards, such as the ISSBs IFRS S1 and S2, adopt a single materiality approach focusing only on the company’s exposure and vulnerability to sustainability matters. CSRD is different and more onerous in requiring a DMA approach.

The DMA considers both impact materiality and financial materiality over the short, medium and long term:

- Impact materiality focuses on how the company impacts the environment, community and people (inside out)

- Financial materiality considers how sustainability matters impact the company (outside in).

To begin, companies need to assess their business context based on business activities, relationships, and affected stakeholders. This should take into account their operations as well as their upstream and downstream value chains.

This process should allow the identification of actual and potential IROs related to sustainability matters. The relevant sustainability matters could include those detailed in ESRS 1, any entity-specific matters, or GRI and SASB matters.

- Impact materiality should assess the identified impacts based on severity and likelihood with quantitative and/or qualitative thresholds. Stakeholder engagement is deemed a highly important part of the process, and helps to gauge the severity of impacts and, ultimately, materiality.

- Financial materiality assesses risks and opportunities based on potential magnitude and likelihood with quantitative and/or qualitative thresholds.

The DMA process results in material IROs, which form the basis of CSRD reporting.

Early compliance advantages

Whilst this new EU directive provides clear challenges on implementation due to the extensive data collection process, scoping requirements, and the level of interoperability with IFRS Sustainability Disclosure Standards, it also provides your company with opportunities and early compliance advantages.

CSRD can give new insights on non-financial indicators that can increase your company’s competitive edge, sustainability performance, investor confidence, and transparency. Early compliance offers you the scope to assess your supply chain and identify possible future challenges that could impact your operations in the long term.

Key considerations in applying CSRD

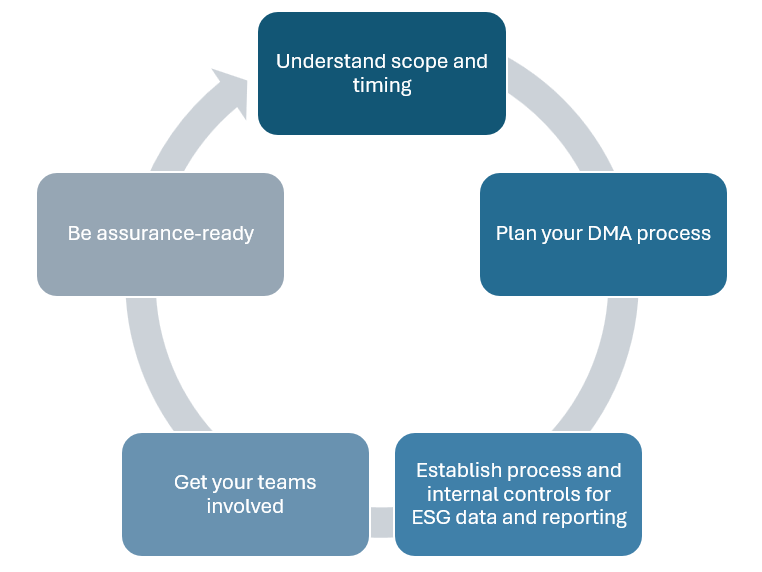

Since the scope and depth of the reporting required by CSRD and ESRS is greater than previous sustainability reporting standards, companies should be proactive and start preparing as early as possible for this complex and time-consuming process.

Although CSRD is an EU regulation, it has an extra-territorial impact, for example on non-EU companies with debt or equity listed on an EU-regulated market and on non-EU groups with subsidiaries or operations in the EU.

Understand scope and timing. As CSRD will be phased in over several years, it’s important to understand when the relevant criteria (see above) will be met and at what date reporting will be required. Groups should also consider if their different companies will meet the criteria at different stages, and whether to report at the company or consolidated level.

Plan your DMA process. The DMA process is the foundation and starting point for reporting, so it’s vital to get this right and allow sufficient time to complete it. Stakeholder engagement is one of the most time-consuming elements of the DMA process. This should be done well before the reporting date to get an idea of what topics are likely to be material and indicate the level and type of disclosures needed.

Establish processes and internal controls for ESG data and reporting. As the ESRSs require a wide range and volume of data, companies should ensure that they have the appropriate processes to make the required data available, accurate and reliable. This applies especially to areas on which the company has not had to report before. The earlier the DMA is considered, the earlier these processes can be checked and any gaps or weaknesses in the data can be identified.

Get your teams involved. Given the wide range of topics ESRS covers, various individuals and teams across the company are likely to be needed to collect and prepare the data to be reported, eg finance, HR, risk, legal, procurement, and sustainability. They must all understand the requirements and their roles/responsibilities for reporting. Engage with them early.

Be assurance-ready. CSRD has a mandatory requirement for limited assurance over the disclosures. The assurance engagement covers:

- compliance with the ESRS, including the process to identify the information reported under the ESRS, ie the DMA process

- compliance with the requirement to mark up sustainability reporting, ie digital tagging (when agreed / adopted by the EU); and

- compliance with the reporting requirements of the EU Taxonomy Regulation (where applicable / reported).

Limited assurance is a negative form of assurance. This means it concludes that nothing has come to the auditors’ attention that causes them to believe that the reporting has not been prepared, in all material respects, in accordance with the applicable criteria.

Limited assurance is typically performed by the International Standard on Assurance Engagements (ISAE) 3000 Revised, Assurance Engagements Other Than Audits or Reviews of Historical Financial Information. But the ISSB has recently developed a new assurance standard – International Standard on Sustainability Assurance (ISSA) 5000 – which is effective for assurance engagements:

- for periods beginning on or after 15 December 2026 or

- at a specific date on or after 15 December 2026.

Given the mandatory assurance requirement in the CSRD, companies must select an assurance provider – often an external auditor. The company should then engage with them early on.

To make the assurance process smoother, companies should formally document activities throughout the reporting process to create an audit trail. This should include detailed documentation of the DMA process and methodologies applied in calculating, measuring and reporting disclosures.

Current and future developments in CSRD

The landscape for sustainability is constantly changing, particularly in light of recent global political developments.

As we’ve said, several EU member states have not yet transposed the current directive into national law and have been pushing back on CSRD requirements. In response to this and other pressures, the EU proposed an ‘Omnibus Simplification Package’ on 26 February, which included some significant reforms to the CRSD (as well as the Corporate Sustainability Due Diligence Directive and the Taxonomy Regulation). The first stage was voted through European Parliament on 3 April 2025, in relation to the postponement of implementation dates as discussed above.

The key reforms are to:

- Reduce the number of companies subject to CSRD by 80% through limiting the scope to large EU companies with more than 1,000 employees on average on their balance sheet date and at least €50 million annual turnover or €25 million balance sheet total.

- For those remaining in scope and would have been required to report in respect of 2025 financial year, delay reporting for two years.

- Introduce value chain cap which would limit the amount of information the companies reporting under CSRD can request from small companies in their value chain.

- Make revisions to the ESRS including: reducing the number of data points to be reported through removing those deemed least important, prioritising quantitative datapoints and further distinguishing between mandatory and voluntary data points; clarifying unclear provisions; improving consistency with other legislation; and providing further guidance on applying the DMA process.

- Cease the development of sector-specific standards.

- Remove the planned transition from limited to reasonable assurance.

The proposed reforms have been submitted to the European Parliament. On 3 April, the European Parliament voted on and approved the two year delay as a first step. The reforms must then be approved by the European Council before being published in the Official Journal of the EU. Finally, the reforms will need to be transposed into national law by EU member states.

Preparing for CSRD: how can we help you?

PKF provides a package of ESG and sustainability assurance services led by a dedicated team. This includes assurance over:

- sustainability statements/reports prepared in accordance with CSRD, TCFD and the UK’s CFD

- ESG metrics and reporting to private equity investors

- ESG KPIs relating to sustainability-linked loans.

For more information on the requirements of CSRD, please get in touch with Jessica Wills, Joseph Archer, Charlie Benton or Christelle Limjap.